Here are five startups coming to the GCV Symposium in London, which are developing technologies for the next generation of green energy.

While there is no shortage of investment in alternative energy sources like hydrogen, sustainable batteries, ammonia and sustainable aviation fuel — about twice as much will be invested in these fields this year as well as into fossil fuel-related developments according to projections by the International Energy Agency. But bringing costs down has been a key hurdle.

A number of startups, backed by SETsquared, a UK enterprise partnership and collaboration between six leading research-led UK universities of Bath, Bristol, Cardiff, Exeter, Southampton and Surrey, are making progress in tackling the cost problem. They are among the 14 startups that will be exhibiting at the GCV Symposium in London this week.

Avena Fuels

- Founded: 2024

- Located: Shannon, Ireland

- Funding raised to date: Undisclosed

Mark Currass (pictured left), CEO and director of Avena Fuels, came up with the idea for the sustainable aviation fuel startup while discussing some of the challenges of traditional fuel refineries with friends at Shannon Airport Group in Ireland.

The concept focused on a decentralised sustainable aviation fuel refinery, without heavy capital expenditure, suitable to be placed near the source of feedstock or integrated directly into airports.

“Then we started some commercial feasibility studies, working with [UK research institute for manufacturing innovation] The Manufacturing Technology Centre, engaging with universities, talking to some really bright people, and it transpired that not only is it possible, it’s feasible. And we have the capability to reduce the capital investment costs from hundreds of millions to 10s of millions and reduce the time it takes to build these facilities from six-seven years to 12-18 months,” Currass says.

With an experienced team of British airline captains in aviation, sitting on aviation boards, Avena Fuels is currently at a technology readiness level (TRL) 2 or 3, meaning it has a ready proof of concept. It is also working with technologies at an advanced TRL 9 where the technology has qualified through successful operations, and integrating them all into a modular system.

Having gone through a feasibility study and currently fundraising in a seed round for £4.7m, the team is estimating to be at production capacity before 2030.

Avena Fuels has also secured a 10-year contractual agreement from a global purchaser of fuels which has committed to buying an initial 10 million litres of fuel a year. “So that tells us once we’re producing fuels, we can sell them into the marketplace immediately,” Currass says.

In the short term, the company is developing a digital twin of its refinery – a digital physics-based environment which will represent the real-world model with artificial intelligence.

The team is working in collaboration with Siemens to develop the digital twin, with all components, from the size of the pipelines to the pressure valves, as well as adding a virtual feedstock and demonstrating the production of virtual aviation fuel.

Latent Drive

- Founded: 2020

- Located: Winfrith Newburgh, Dorset, UK

- Funding raised to date: $2.2m

The idea for this green hydrogen startup came during the pandemic when there was a shortage of oxygen for the treatment of covid-19 patients. Responding to a UK government call for technologies to help with the shortage, Frazer Ely (pictured left) and his son proposed a device that would extract oxygen from the atmosphere and compress it for use in hospitals.

“We were doing electrochemistry. I’d already been working on electrochemical devices, energy harvesting, and we were splitting and rejoining water molecules within stacks of cells like this. Basically, the same technology as fuel cells and electrolysers,” Ely, CEO of Latent Drive, says.

Following the pandemic, when their help wasn’t needed for oxygen production, they pivoted to focus on green hydrogen.

Ely’s team focused, in particular, in bringing down the cost of green hydrogen production. They engineered their own catalysed electrodes – called catrodes — using industrial stainless steel instead of the much more expensive platinum-coated version.

“The fundamental problem is that green hydrogen is too expensive. People don’t talk about that enough. Green hydrogen costs maybe four or five times as much as hydrogen created from fossil fuels,” says Ely. So the potential of the proprietary technology bringing the cost down is key.

With electricity supply also attaching significant costs to the production of green hydrogen, the team came up with the idea of getting their electrolysers to the source of energy, in this case offshore wind farms in the North Sea.

That’s how they created SeaStack, the first commercial electrolyser designed to go offshore to the wind farm and harvest the energy directly. Latent Drive also designed the technology to run with sea water, instead of having to purify it first.

Being developed side by side, the two technologies are at different stages. “The catrodes are at an advanced stage as we’re now setting up manufacturing facilities for catrodes and getting orders and inquiries in. But SeaStack is at an early stage and it’s going to be a few years before this is ready to go to market,” Ely says.

As a next step in the development of the technologies, Latent Drive is doing a demonstration project, called Hydroport, funded by Innovate UK, at the underused Portland Port in the south of England, powering the harbour patrol boat with hydrogen while developing its prototype SeaStacks.

Rhizo PTX

- Founded: 2024

- Located: Guildford, Surrey, UK

- Funding raised to date: Undisclosed

Ash Stott and Ben Kyffin are co-founders of green ammonia startup Rhizo PTX, which recently came out of stealth mode. The pair generated the idea for the company during their long commute while working as colleagues at a West Sussex-based firm developing clean energy technology.

As senior electrochemist and materials chemist, Stott and Kyffin were musing about the next generation of fuel, which led them to develop an electrochemical system that directly converts nitrogen, water and electricity into carbon-free green ammonia.

“The standard way of making green ammonia is making hydrogen, then feeding it into a Haber-Bosch reactor, combining it there and then creating green hydrogen. But we’re doing it in a one-step electrochemical way,” Kyffin, now CTO of Rhizo PTX, says.

The main goal of the business is to reduce the cost of green ammonia. The traditional approach of first making green hydrogen and then converting it into green ammonia is not cost competitive with gray ammonia (produced with fossil fuels), because of the longer process it requires.

“Our system is a direct single-step process, which allows us to also unlock the use of intermittent renewable energy, because our system can ramp up and ramp down very quickly with intermittent power,” Stott explains.

In addition to lower costs, the company can use cheaper materials as the technology doesn’t require the use of expensive materials, such as platinum or iridium, increasing the potential for a much more cost competitive green ammonia.

The company just raised a pre-seed round from a venture capital investor, helping it purchase specialised equipment, and has set up a laboratory space in Guildford, south England.

Rhizo PTX is currently at TRL 3, meaning it has completed a proof of concept as it aims to reach commercial scale within the next five years.

The founders are looking to partner with people in the commodity and chemicals trade of ammonia willing to try out a new business model for green ammonia.

“We are considering a new type of business model where instead of selling intellectual property or selling electrochemical systems, we sell the product of our electrochemical system – green ammonia,” Stott says.

There still aren’t many ecosystems in place for selling green ammonia, says Stott. “There’s a lot of interest in creating these systems. The main drivers are new emerging markets and the fact that ammonia can be used as a shipping fuel and as a hydrogen carrier – it’s easier to move ammonia than it is to move hydrogen and you can very easily convert it into hydrogen,” he says.

Its use is also rising in countries like South Korea whose government plans to import 9.27 million tons of ammonia produced from renewable energy and gas by 2030.

Global Nano Network

- Founded: 2018

- Located: Coventry, West Midlands, UK

- Funding raised to date: Undisclosed

Ravi Daswani (pictured left), founding partner and CEO of Global Nano Network (GNN), says the team started with the motivation to reduce toxic chemicals required to produce lithium-ion batteries.

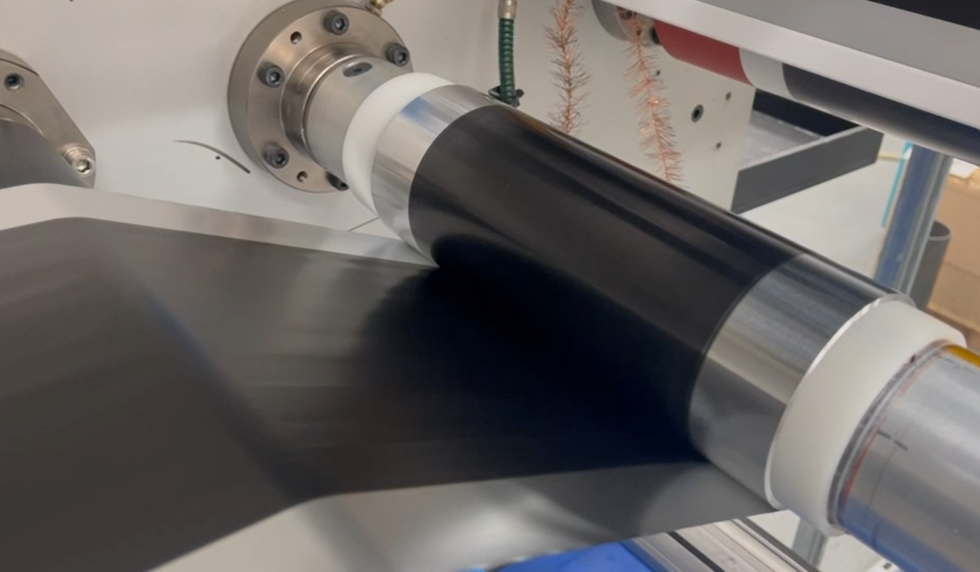

The wet chemical process used to make these batteries involves liquefying materials with solvents in an extremely toxic process that uses a great deal of energy as the materials are re-dried afterwards.

“That’s exactly what we fixed at GNN. We got rid of the requirement to use toxic solvent by transitioning from a wet to a dry chemical process. So, what that means is we can go straight from powder to producing the cathode, which means you can reduce your energy intensity,” Daswani, says.

The dry materials manufacturing process has historically had a higher failure rate, but GNN developed a novel step using a technology called hyper foil, which improved efficiency.

This patented technology allows the company to reduce the cost of one specific component in a battery by close to 20% and reduce energy consumption and carbon emissions by close to 50%.

The startup is currently at TRL 5 or 6, meaning it is scaling up and starting to work with large organisations, both as suppliers and potential customers. Meanwhile, it is looking to build the first manufacturing plant for its hyper foil core technology.

With current market pressures and high costs of producing batteries outside the already established manufacturing supply chains in East Asia, competing against those producers doesn’t just involve setting up more businesses elsewhere, “the only real opportunity [to compete] is using technologies that can help reduce costs automation, and this is really what we’re focusing on,” Daswani says.

“This means leapfrogging completely what they’re doing in China today. Instead of using wet chemical processes, let’s focus on the environment. Let’s make ESG a priority and then let’s provide the right technologies that are going to help not only reduce costs but meet the CO2 emission targets.”

Volador Energy

- Founded: 2023

- Located: Mildenhall, Suffolk, UK

- Funding raised to date: Undisclosed

The idea for this battery startup emerged while Sachin Ramesh (pictured left) was developing an electric aircraft at aerospace company Volador FlyTech.

“We faced significant limitations with existing battery technologies – especially in safety, reliability and performance. As interest grew specifically in our battery innovations, we spun off the battery division into a dedicated, independent company to focus on scalable, sustainable energy storage for diverse sectors,” says Ramesh, now director and CEO of the spin-out, Volador Energy.

The battery startup aims to bridge critical gaps in the energy storage market by offering batteries that are modular, repairable at the cell level and free from toxic adhesives or welds.

Its proprietary press-fit casing aims to simplify maintenance and extend lifecycle while optional immersion cooling can enhance safety for high-demand or sensitive environments. This can contribute to grid resilience, off-grid applications and decarbonisation goals.

Immersion-cooled battery systems are gaining traction for their superior thermal management and safety, especially in high-performance sectors like off-road electric vehicles, aviation and industrial energy.

While the market for such batteries is niche and complexity and cost currently remain as adoption barriers, “our modular approach and use-case adaptability help overcome these challenges,” Ramesh adds.

The startup is currently focused on completing certifications, scaling manufacturing and commercialising minimum viable product. “With pilot projects in the UK and India, and strong interest from energy and infrastructure firms globally, we aim to enter new markets by late 2026,” Ramesh says.

These energy startups are part of 14 emerging companies that will be at the GCV Symposium in London on June 18 and 19. This is the full list of startups at the event:

- Minviro

- Kargenera

- Morpheus Fluid

- FluoretiQ

- IngeniumAI

- Astratus

- Ferryx

- Pure Energy (REGen)

- Volador Energy

- Latent Drive

- Hyflux

- Global Nano Network

- Avena Fuels

- Rhizo PTX