What the experts say: Higher taxes likely

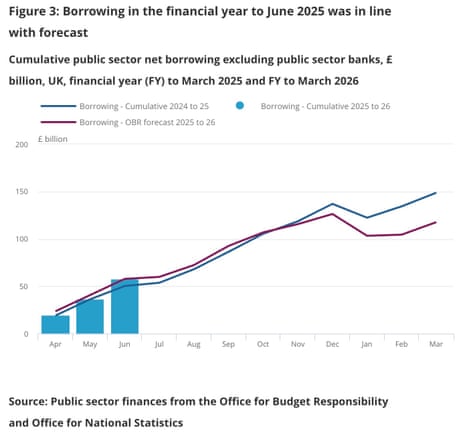

Despite public borrowing overshooting official forecasts by £3.6bn in June, to over £20bn, borrowing is still in line with the OBR’s forecasts after the first three months of the fiscal year, points out Alex Kerr, UK economist at Capital Economics.

But… Kerr fears things will probably get worse for the Chancellor, forcing her to raise between £15-25bn at the Budget later this year, probably mostly through higher taxes.

Kerr told clients:

Admittedly, the better-than-expected start to the fiscal year means that borrowing is still on track to meet the OBR’s existing forecasts after the first three months of the 2025/26 fiscal year.

But the government’s u-turns on spending cuts and potential upward revisions to the OBR’s borrowing forecasts means the Chancellor will probably need to raise £15-25bn at the Autumn Budget to maintain the £9.9bn of headroom against her fiscal mandate.

And given that she is struggling to stick to existing spending plans and we doubt the gilt market will tolerate significant increases in borrowing, she will probably have to raise taxes instead.

Dennis Tatarkov, senior economist at KPMG UK, has warned that June’s higher borrowing piles more pressure on public finances, which could mean spending cuts or tax rises.

Tatarkov explains:

“Higher than expected interest payments as well as weaker revenues have pushed borrowing above the OBR’s projection for the second month in a row.

“Furthermore, the longer-term outlook for public finances remains difficult. Recent U-turns on welfare and persistent growth headwinds could open a gap against fiscal targets, which could require further tax rises or spending cuts in the Autumn Budget. To the extent that ongoing deficits point to lingering budgetary pressures, we would expect the OBR to acknowledge these at the next fiscal event.”

Richard Carter, head of fixed interest research at Quilter Cheviot, says today’s UK public sector finances “highlight the parlous state of the government’s fiscal position”, adding:

“Recent events have shown how hard it is for the government to bring spending down. Welfare reform was heavily watered down, while winter fuel payments have been reinstated for millions. As we approach the summer recess this is all going to result in additional speculation of what tax rises will be coming down the line given the need to plug the holes. Bond markets are craving some fiscal discipline, so without any spending cuts, taxes will have to rise.

“This is all going to negatively impact the UK’s growth position. Labour continually speaks about achieving economic growth but if taxes do need to keep rising to cater for an ever increasing debt, that growth is going to prove elusive.”

Key events

FTSE 100 hits new intraday high

Despite the gloomy UK borrowing data, the London stock market has hit a new record peak this morning.

The blue-chip FTSE 100 index jumped to 9025 points in early trading, a day after closing above the 9,000 point mark for the first time.

The rally was led by food services group Compass, which raised its profit forecast for this year and announced the acquisition of European premium food services business Vermaat Groep. Compass’s shares are up 4.2%.

They’re followed by Centrica (+4%), following this morning’s confirmation that it is taking a 15% stake in the Sizewell C nuclear power station.

Mining stocks are rallying too, lifted by higher commodity prices.

FCA warns insurers to stop poor practices

Lauren Almeida

Insurers need to improve the way they handle home and travel claims, the financial regulator said this morning.

The Financial Conduct Authority has uncovered “concerning evidence” of poor practice among some home and travel insurers, which has led to delays in settling claims and high numbers of complaints. There has been a “lack of oversight of outsourced services” in some cases, the regulator said, as well as “insufficient management information”.

The FCA also found high rejection rates for storm damage claims, with only 32% of claims in its sample receiving a payment in 2024. The regulator also found cases of cash settlements being used “without sufficient consideration of whether they are most suitable”.

The watchdog is also reviewing high premiums in the car insurance industry, although it found the rise in costs has been driven by factors largely outside insurers’ control, such as higher prices for cars, parts, labour and energy. The cost of hire vehicles, as well as the number and cost of theft claims and uninsured drivers, have also risen significantly, it said.

However, it found evidence in the car insurance market that referral fees from credit hire firms and claims management companies were “associated” with slower claims processing and higher costs.

Sarah Pritchard, deputy chief executive of the FCA, said:

“External cost pressures are primarily to blame for recent motor premium increases, not increased firm profits, but there is some more work to do on claims handling, particularly in home and travel.

That’s why we’re stepping up – making sure claims are handled promptly and fairly and pushing for a coordinated effort to tackle the root causes of rising motor premiums.

A well-functioning insurance market helps consumers navigate their financial lives and supports growth by building people’s resilience to financial and personal shocks.”

UK bond yields rise after jump in borrowing

UK bond prices are weakening, which pushes up the cost of borrowing, as traders digest this morning’s public finances report.

The yield, or interest rate, on 10-year UK bonds has risen by two basis points (0.02 percentage points) to 4.634%.

Longer-dated, 30-year, bond yields have risen by almost three basis points to 5.463%, towards the 27-year highs above 5.5% reached in April.

Yields rise when bond prices fall. Although these are small moves, they add to the pressures on the UK public finances, as higher borrowing costs eat into Rachel Reeves’s limited headroom against her fiscal targets.

UK grocery inflation jumps to 5.2%

More bad news: UK grocery inflation has jumped to its highest level since January 2024, as the cost of living squeeze intensifies.

Data provider Worldpanel by Numerator, has reported that grocery inflation accelerated in the last four weeks, to 5.2% year-on-year. That’s up from 4.7% in the previous month.

Fraser McKevitt, head of retail and consumer insight at Worldpanel, says the annual cost of household shopping is rising sharply:

With the average household spending £5,283 each year at the grocers, this latest rise could add £275 to bills if people’s shopping habits stay the same.

Just under two thirds of households say they are very concerned about the cost of their grocery shopping*, and people are adapting their habits to avoid the full impact of price rises. Own label products, which are often cheaper, continue to be some of the big winners and, in fact, sales of these ranges are again outpacing brands, growing by 5.6% versus 4.9%.

What the experts say: Higher taxes likely

Despite public borrowing overshooting official forecasts by £3.6bn in June, to over £20bn, borrowing is still in line with the OBR’s forecasts after the first three months of the fiscal year, points out Alex Kerr, UK economist at Capital Economics.

But… Kerr fears things will probably get worse for the Chancellor, forcing her to raise between £15-25bn at the Budget later this year, probably mostly through higher taxes.

Kerr told clients:

Admittedly, the better-than-expected start to the fiscal year means that borrowing is still on track to meet the OBR’s existing forecasts after the first three months of the 2025/26 fiscal year.

But the government’s u-turns on spending cuts and potential upward revisions to the OBR’s borrowing forecasts means the Chancellor will probably need to raise £15-25bn at the Autumn Budget to maintain the £9.9bn of headroom against her fiscal mandate.

And given that she is struggling to stick to existing spending plans and we doubt the gilt market will tolerate significant increases in borrowing, she will probably have to raise taxes instead.

Dennis Tatarkov, senior economist at KPMG UK, has warned that June’s higher borrowing piles more pressure on public finances, which could mean spending cuts or tax rises.

Tatarkov explains:

“Higher than expected interest payments as well as weaker revenues have pushed borrowing above the OBR’s projection for the second month in a row.

“Furthermore, the longer-term outlook for public finances remains difficult. Recent U-turns on welfare and persistent growth headwinds could open a gap against fiscal targets, which could require further tax rises or spending cuts in the Autumn Budget. To the extent that ongoing deficits point to lingering budgetary pressures, we would expect the OBR to acknowledge these at the next fiscal event.”

Richard Carter, head of fixed interest research at Quilter Cheviot, says today’s UK public sector finances “highlight the parlous state of the government’s fiscal position”, adding:

“Recent events have shown how hard it is for the government to bring spending down. Welfare reform was heavily watered down, while winter fuel payments have been reinstated for millions. As we approach the summer recess this is all going to result in additional speculation of what tax rises will be coming down the line given the need to plug the holes. Bond markets are craving some fiscal discipline, so without any spending cuts, taxes will have to rise.

“This is all going to negatively impact the UK’s growth position. Labour continually speaks about achieving economic growth but if taxes do need to keep rising to cater for an ever increasing debt, that growth is going to prove elusive.”

UK strikes deal with private investors to build £38bn Sizewell C nuclear power plant

Jillian Ambrose

Britain’s monthly borrowing in June would have paid for half a nuclear power station!

The UK government has, thiss morning, struck a deal worth more than £38bn with private investors to back Britain’s biggest nuclear project in a generation at the Sizewell C site on the Suffolk coast, my colleague Jillian Ambrose reports.

The long-awaited multibillion-pound deal brings together investment from the UK government and Sizewell C’s developer, the French energy group EDF, with a consortium of three other investors including the British Gas parent company Centrica.

The UK government’s stake in the project stood at 84% at the end of last year compared with EDF’s 16% share of the project. Under the final deal, the government will remain the project’s largest shareholder, with a 44.9% stake, while the French utility’s share shrinks to 12.5%.

Centrica will take a 15% share of the project while the Canadian investment group La Caisse will hold 20%, and investment manager Amber Infrastructure will take an initial 7.6%.

The final agreement marks the end of a 15-year journey to secure investment for the nuclear plant since Sizewell C was first earmarked for new nuclear development in 2010…

More here:

As this chart shows, the UK’s national debt (estimated at 96.3% of GDP) is its highest since the early 1960s.

The picture is a little better, though, if we use the chancellor’s favoured debt measures, Public sector net financial liabilities (PSNFL). “Persnuffle” excluding public sector banks was just over £2.5tn at the end of June, or 83.8% of GDP, £178.9bn more than a year ago.

PSNFL take into account all the government’s financial assets and liabilities, including student loans and equity stakes in private companies, as well as funded pension schemes.

It gives the chancellor room to increase borrowing for investment in long-term infrastructure.

Allow content provided by a third party?

This article includes content hosted on ons.gov.uk. We ask for your permission before anything is loaded, as the provider may be using cookies and other technologies. To view this content, click ‘Allow and continue’.

How government spending rose faster than income in June

Borrowing jumped in June because UK government spending rose rather faster than its income.

Central government’s current receipts did rise last month, by £5.7bn, to £86.8bn.

That increase was due to higher tax receipts, namely:

-

central government tax receipts increased by £2.3bn to £63.6bn; this included increases of £1.0bn in Income Tax, £0.7bn in Value Added Tax (VAT), and £0.5bn Corporation Tax receipts

-

compulsory social contributions increased by £3.1bn to £17.4bn, on 6 April 2025 changes to the rate of National Insurance contributions paid by employers came into effect

But this was more than eaten up by a £12.4bn jump in central government’s current expenditure, to £97.1bn, because:

-

central government debt interest payable increased by £8.4bn to £16.4bn, largely because the interest payable on index-linked gilts rises and falls with the Retail Prices Index (RPI)

-

central government departmental spending on goods and services increased by £2.0bn to £37.2bn, as pay rises and inflation increased running costs

-

net social benefits paid by central government increased by £1.5bn to £26.5bn, largely caused by inflation-linked increases in many benefits and earnings-linked increases to state pension payments

-

payments to support the day-to-day running of local government decreased by £0.4bn to £12.3bn, these intra-government transfers are both central government spending and a local government receipt, so they have no effect on overall public sector borrowing

Interest payable on central government debt rose to £16.4bn in June

Most of the UK government’s borrowing last month was to service existing national debt.

The interest payable on central government debt more than doubled to £16.4bn in June 2025, £8.4bn more than in June 2024.

That’s £2.4bn more than the £14.0bn forecast by the Office for Budget Responsibility (OBR), and the second-highest for any June apart from in 2022.

The increase is driven by index-linked gilts, where the interest rate on the bonds rises and falls in line with the RPI measure of inflation.

UK borrowing jumps to £20.7bn in June

Newsflash: Britain borrowed more than expected last month, as the pressures on the public finances grow and debt interest costs rise.

Borrowing jumped to £20.7bn in June 2025, some way over City forecasts for £16.5bn, which will add to the pressure on chancellor Rachel Reeves.

That’s £6.6bn more than in June 2024 and the second-highest June borrowing since monthly records began in 1993 (beaten only by June 2020, when the Covid-19 pandemic drove up government spending).

Worryingly for the chancellor, it’s also £3.5bn more than the £17.1bn forecast by the Office for Budget Responsibility, which may fuel speculation that the government will breach its fiscal rules unless it raises taxes or cuts spending.

The jump was partly driven by higher interest payments on the UK’s national debt, on bonds linked to inflation, which wiped out the recent increase in businesses taxes.

Public sector net borrowing excluding public sector banks was £20.7 billion in June 2025.

This was £6.6 billion more than in June 2024 and the second-highest June borrowing since monthly records began in 1993, behind that of June 2020.

Read more ➡️ https://t.co/WBro41C2I8 pic.twitter.com/vIH9h3r21D

— Office for National Statistics (ONS) (@ONS) July 22, 2025

ONS acting chief economist Richard Heys said:

“Borrowing in the month of June was over £6bn higher than during the same time last year.

“The rising costs of providing public services and a large rise this month in the interest payable on index-linked gilts pushed up overall spending more than the increases in income from taxes and National Insurance contributions, causing borrowing to rise in June.”

Concerns about the state of the public finances have been rising since the government rowed back on reforms to welfare spending after a revolt among its own MPs, a move that will eat into the chancellor’s fiscal headroom.

Glenn Youngkin, governor of the Commonwealth of Virginia, has cheered AstraZeneca’s decision to build its new multi-billion dollar drug substances plant in his state.

Youngkin, who appeared alongside AstraZeneca’s CEO Pascal Soriot at last night’s signing ceremony, says:

“I want to thank AstraZeneca for choosing Virginia as the cornerstone for this transformational investment in the United States. This project will set the standard for the latest technological advancements in pharmaceutical manufacturing, creating hundreds of highly skilled jobs and helping further strengthen the nation’s domestic supply chain.

Advanced manufacturing is at the heart of Virginia’s dynamic economy, so I am thrilled that AstraZeneca, one of the world’s leading pharmaceutical companies, plans to make their largest global manufacturing investment here in the Commonwealth.”

AstraZeneca’s new US investment plans

Here’s where AstraZeneca plans to spend its $50bn:

-

Expansion of its R&D facility in Gaithersburg, Maryland

-

State-of-the-art R&D centre in Kendall Square, Cambridge, Massachusetts

-

Next-generation manufacturing facilities for cell therapy in Rockville, Maryland and Tarzana, California

-

Continuous manufacturing expansion in Mount Vernon, Indiana

-

Specialty manufacturing expansion in Coppell, Texas

-

New sites to supply clinical trials

Introduction: AstraZeneca unveils $50bn US investment

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

AstraZeneca has become the latest multinational company to announce a major investment in the US since Donald Trump began his trade wars.

AstraZeneca announced last night it will invest $50bn in the US by 2030, building new manufacturing facilities and expanding existing sites.

It says the plan – which has the seal of approval from the White House – will create tens of thousands of new, highly skilled direct and indirect jobs across America. It could also help AstraZeneca to reach a point where half its revenues are generated in the US.

The plan includes building a new drug substance facility in the Commonwealth of Virginia, which will produce small molecules, peptides and oligonucleotides. That would be AstraZeneca’s largest single manufacturing investment in the world.

The move comes as the pharmaceuticals industry braces for Trump to impose new tariffs on their wares entering the US, possibly as soon as 1 August.

Pascal Soriot, chief executive officer at AstraZeneca, says:

“Today’s announcement underpins our belief in America’s innovation in biopharmaceuticals and our commitment to the millions of patients who need our medicines in America and globally. It will also support our ambition to reach $80 billion in revenue by 2030.”

This investment splurge also comes amid reports that Soriot has been considering shifting AstraZeneca’s stock market listing from the UK to the US. AstraZeneca is currently the second most valuable company on the London stock exchange, shortly behind HSBC.

Howard Lutnick, US Secretary of Commerce, has welcomed the plan, saying:

“For decades Americans have been reliant on foreign supply of key pharmaceutical products. President Trump and our nation’s new tariff policies are focused on ending this structural weakness.

We are proud that AstraZeneca has made the decision to bring substantial pharmaceutical production to our shores. This historic investment is bringing tens of thousands of jobs to the US and will ensure medicine sold in our country is produced right here.”

The agenda

-

7am BST: UK public finances for June

-

10.15am BST: Bank of England governor Andrew Bailey to be grilled by Treasury committee MPs about financial deregulation

-

1.30pm BST: Fed chair Jerome Powell speech at the Integrated Review of the Capital Framework for Large Banks Conference, Washington, D.C.

-

2pm BST: Rachel Reeves to appear before Lords economics affairs committee