Boeing has announced a plan to raise up to $25bn through stock and debt offerings and a $10bn credit agreement with major lenders to address its financial challenges amid a production and regulatory crisis. The announcement was made on Tuesday.

The exact amount to be raised through the offerings has not been specified, but analysts estimate that Boeing will need to raise between $10bn and $15bn to maintain its credit ratings, which are currently just above junk status.

The company is facing a decrease in production of its popular 737 MAX jet due to various issues, including a mid-air incident earlier this year and a strike by thousands of US union workers since September 13.

Boeing stated that it has not used the new $10bn credit facility arranged by major banks like BofA, Citibank, Goldman Sachs, and JPMorgan, or its existing revolving credit facility.

According to Boeing, these measures are meant to support the company’s liquidity access. The potential stock and debt offerings will provide options to strengthen its balance sheet over a three-year period.

Boeing’s shares saw a 1.6 percent increase on Tuesday. S&P Global and Fitch had previously warned of a possible downgrade, but they now believe the stock and debt offerings could help maintain Boeing’s investment-grade rating.

Although some analysts have reservations, Boeing’s actions seem to be a prudent move to secure additional funding and prevent a downgrade. However, there are concerns about the company’s short-term liquidity.

Emirates Airlines president Tim Clark expressed doubts about Boeing’s ability to overcome its current crisis without financial assistance. He warned of a potential investment downgrade and the looming threat of Chapter 11 bankruptcy.

Boeing intends to use the funds for general corporate purposes based on paperwork filed with the US markets regulator on Tuesday. As of June 30, the company had cash and cash equivalents amounting to $10.89bn.

Rising costs

One estimate suggests that the ongoing strike is costing Boeing more than $1bn per month. The company recently announced plans to cut 17,000 jobs, equivalent to 10 percent of its global workforce, to address the financial impact of the strike.

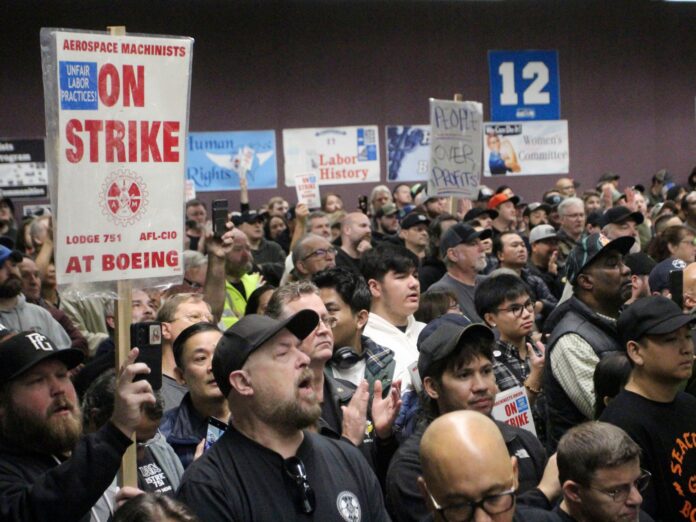

Negotiations between Boeing and the Machinists Union have not yet resulted in a new contract, and tensions are escalating. The strike has continued with workers expressing solidarity and determination to fight for their rights.

US Acting Deputy Secretary of Labor Julie Su intervened in the negotiations on Monday in an effort to find a resolution to the deadlock. Meanwhile, US Representative Pramila Jayapal delivered a passionate speech at a rally, criticizing Boeing’s priorities and urging the company to end the strike.