The Federal Reserve has decreased its key interest rate by a quarter-point on Thursday in response to the steady decrease in inflation that had led to Donald Trump’s election victory this week.

The rate cut comes after a larger half-point reduction in September, showing the Fed’s focus on supporting the job market and combating inflation, which is now just above the bank’s 2% target.

Thursday’s adjustment lowers the Fed’s benchmark rate to about 4.6%, down from a 5.3% four-decade high before September’s meeting. The Fed had maintained the rate at that level for over a year to tackle the highest inflation in four decades. Inflation has dropped from a peak of 9.1% in mid-2022 to a 3 1/2-year low of 2.4% in September.

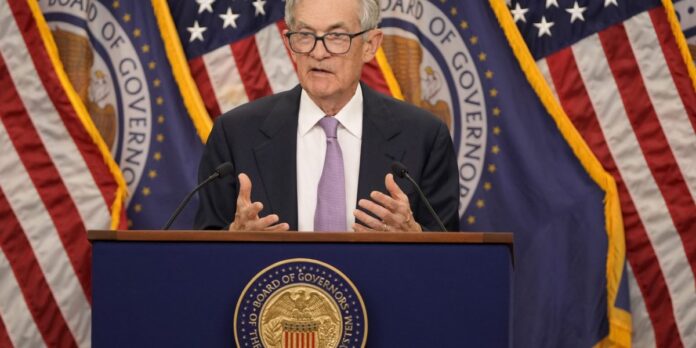

When asked in a press conference about how Trump’s election would impact the Fed’s decision-making, Chair Jerome Powell stated that “in the immediate future, the election will not affect our (interest rate) choices.”

Despite his election, Trump’s interference in the Fed’s policy decisions has been raised as a concern, with Trump claiming that as president, he should have a say in interest rate decisions. The Fed has historically protected its independence to make tough rate decisions without political influence. However, during Trump’s first term, he publicly criticized Powell after the Fed raised rates to combat inflation, and he may do so again.

When asked at the press conference if he would resign if Trump requested it, Powell, who has one year left in his second term as Fed chair when Trump assumes office, simply replied, “No.” He clarified that Trump could not dismiss or demote him, as it is “not allowed by law.”

In a statement following the latest meeting, the Fed acknowledged that the “unemployment rate has increased but remains low,” and although inflation has decreased closer to the 2% target, it “remains somewhat elevated.”

After the rate cut in September, the Fed anticipated further quarter-point cuts in November and December, with four more next year. However, with the economy showing strength and the expectation of faster growth under a Trump presidency, additional rate cuts may be less probable.

Powell indicated that the Fed plans to continue lowering its key rate towards a “neutral” level that neither hinders nor stimulates growth. Despite uncertainties, the Fed’s goal remains unchanged. The economy’s mixed signals — solid growth but weakening hiring — complicate the situation.

Financial markets have responded by raising Treasury yields since the rate cut in September, affecting borrowing costs across the board. Trump’s proposed policies, such as tariffs and taxes, could potentially raise inflation rates, affecting the Fed’s rate cuts. Annual inflation rates could climb back up to 2.75% to 3% by mid-2026 due to these actions.

Rate cuts usually lead to lower borrowing costs, but this time, mortgage rates have risen as the economy continues to grow, fueled by consumer spending. The challenge for the Fed lies in supporting the economy by reducing borrowing costs, which may not yield the desired results if investors push up longer-term borrowing rates.

The economy has shown growth just under 3% over the past six months, with consumer spending driving the quarter from July-September quarter. However, hiring has dwindled, with many job seekers struggling to find work. Powell has hinted that the Fed is lowering rates to improve job prospects, but increased growth and inflation could prompt the Fed to reconsider its rate cuts.

A newsletter for the boldest, brightest leaders:

CEO Daily is your weekday morning briefing on the news, trends, and discussions that business leaders should be aware of.

Sign up here.