Mortgage giant claims lenders who embrace automation enjoy fewer loan defects and cut loan production time and cost compared to lenders with lower technology utilization.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Intercontinental Exchange’s digital mortgage lending platform, Encompass, has been upgraded to provide deeper integrations with mortgage giant Freddie Mac’s automated underwriting system, Loan Product Advisor (LPA).

Encompass now has access to feedback messages from Loan Product Advisor that offer “actionable responses” when issues arise over debt-to-income ratios, loan-to-value ratios and reserves, helping lenders “make faster, informed decisions and turn more cautions into accepts,” Freddie Mac announced Wednesday.

Encompass users also get feedback on whether loans are eligible for employment representation and warranty relief, and whether loans may qualify for automated valuations and appraisal alternatives.

Tim Bowler

“Encompass users can now seamlessly access Freddie Mac’s latest LPA offerings as part of their existing workflows,” ICE Mortgage Technology President Tim Bowler said in a statement. “As always, the goal is to increase efficiency, lower costs and help lenders put more qualified borrowers into homes they can afford.”

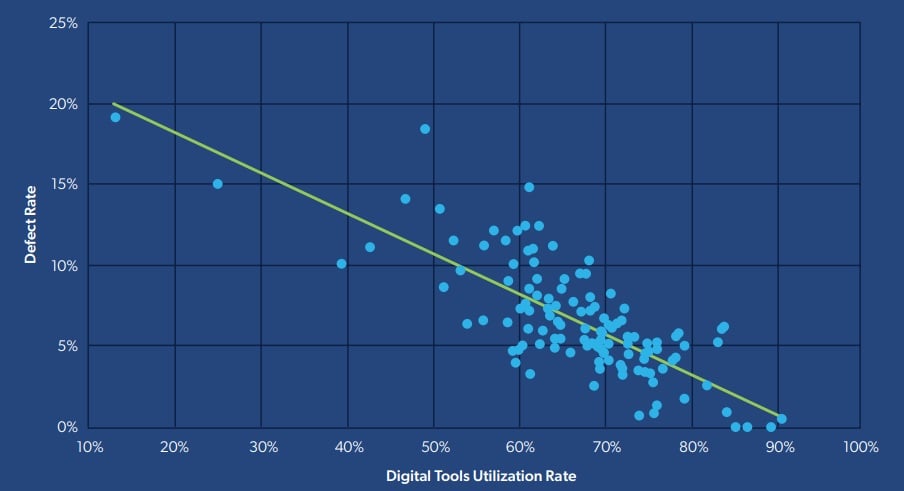

Technology decreases loan defect rate

Lenders who embrace technology experience lower loan defect rates than competitors. Source: Freddie Mac

Freddie Mac pointed to a February 2023 study that found lenders who embraced its automated offerings had 40 percent fewer loan defects, saved $1,700 in costs and cut loan production times by seven days compared to lenders with lower technology utilization.

Kevin Kauffman

Technology “is empowering lenders to originate more loans eligible for sale to Freddie Mac without changing their workflow,” Freddie Mac executive Kevin Kauffman said, in a statement. “We’re also arming lenders with more detailed information around purchase requirements as well as cost-saving options for first-time homebuyers.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter