“Better Forever” incentive is not offered on HELOCs, nor to borrowers who apply through third-party platforms like LendingTree, CreditKarma, Bankrate or Nerdwallet.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain powerful insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

Better Mortgage is looking to do more repeat business by offering to waive its $995 origination fee when previous customers refinance or take out another purchase loan.

The “Better Forever” loyalty program, announced Wednesday, applies to past customers who have done business with Better Mortgage since Jan. 1, 2019, and to future customers.

Vishal Garg | Better

“Homeowners deserve to feel confident in the interest rate tied to their mortgage for the life of their loan, not just when they complete their transaction,” Better founder and CEO Vishal Garg said, in a statement. “With Better Forever, we can help borrowers begin benefitting from their purchase or refinance today, without the fear of missing out on a better rate tomorrow.”

Better says borrowers have to wait at least six months before refinancing to qualify for “Better Forever,” and that the loyalty program doesn’t include home equity loans or home equity lines of credit (HELOCs).

Also, the Better Forever origination fee waiver isn’t offered to borrowers who apply through third-party platforms like LendingTree, CreditKarma, Bankrate or Nerdwallet.

“Come to us directly so we can offer this deal!” Better advises on its website.

In the past, Better has counted on business-to-business (“B2B”) partners like Ally Financial for up to half of its originations. Ally originated $1 billion in mortgages in 2023 through a partnership with Better, and is also an investor in the company.

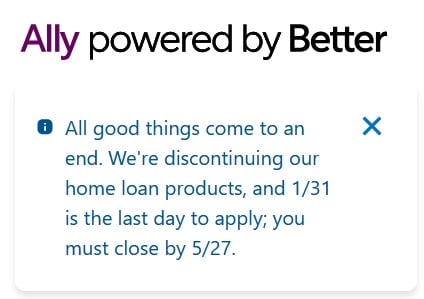

But Ally announced in January that it would lay off hundreds of employees and exit the mortgage business.

Source: AllyHomeLoans.com.

“All good things come to an end,” a message on the website informed visitors on Feb. 5. “We’re discontinuing our home loan products, and 1/31 is the last day to apply; you must close by 5/27.”

In addition to loan origination fees, application and closing costs typically include fees for credit reports, appraisal fees and title insurance, the Consumer Financial Protection Bureau (CFPB) advises consumers.

Many lenders offer “no-cost” refinancing, which may involve borrowers accepting a higher interest rate than they might otherwise qualify for, or adding closing costs to the loan amount, the CFPB notes.

Anticipating that a pullback in interest rates might renew interest in refinancing, on Veterans Day Better announced the addition of VA Interest Rate Reduction Refinance Loans (VA IRRRL) to its product lineup.

A streamlined process allows borrowers to refinance their existing VA loans with no appraisal, asset or income verification requirements and offers easier credit qualifications to help homeowners to secure lower interest rates.

“As we look ahead with optimism to a more favorable interest rate environment, we are proud to simplify the refinancing process for veterans, helping those who have served our country save money and secure their financial future,” Garg said in a statement.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter