Purchase loan requests are up 7 percent from a year ago, as loosening housing inventory and a pullback in mortgage rates presents FHA buyers with more opportunities.

Bigger. Better. Bolder. Inman Connect is heading to San Diego. Join thousands of real estate pros, connect with the power of the Inman Community, and gain insights from hundreds of leading minds shaping the industry. If you’re ready to grow your business and invest in yourself, this is where you need to be. Go BIG in San Diego!

Homebuyer demand for home loans picked up slightly last week, with mortgage rates continuing to hover near their lows for the year amid lingering uncertainty over the U.S. economy and future trade policy.

Requests for purchase loans were up by a seasonally adjusted 1 percent last week compared to the week before, and 7 percent from a year ago, according to a weekly survey of lenders by the Mortgage Bankers Association (MBA).

Purchase applications came in at the strongest weekly pace in almost two months, driven primarily by a 6 percent increase in FHA applications, MBA Deputy Chief Economist Joel Kan said.

TAKE THE INMAN INTEL INDEX SURVEY FOR MARCH

Joel Kan

“The combination of loosening housing inventory and slowly declining mortgage rates has presented this segment of buyers with more opportunities,” Kan said in a statement.

Requests to refinance were down 5 percent week over week, but refi demand was still up 63 percent from a year ago.

The Fed took some pressure off mortgage rates last week by announcing that it will slow down the pace at which it trims government debt from its balance sheet to $5 billion a month starting in April.

But policymakers at the central bank indicated they’re more worried about inflation than they were in December and aren’t ready to resume cuts to short-term interest rates initiated last year.

“Markets remained focused on potential trade policy changes, while the Fed held the funds rate at its current level,” Kan said.

Mortgage rates hover near March 3 bottom

After declining from a 2025 peak of 7.05 percent to hit a low for the year of 6.55 percent on March 3, rates on 30-year fixed-rate mortgages have been staying close to that level, according to rate lock data tracked by Optimal Blue.

But surveys of consumers by the University of Michigan and the Conference Board show many Americans are worried that tariffs could reignite inflation — or spark a trade war that leads to a recession.

The Conference Board Consumer Confidence Index fell for the fourth month in a row in March to 92.9, the business think tank reported Tuesday.

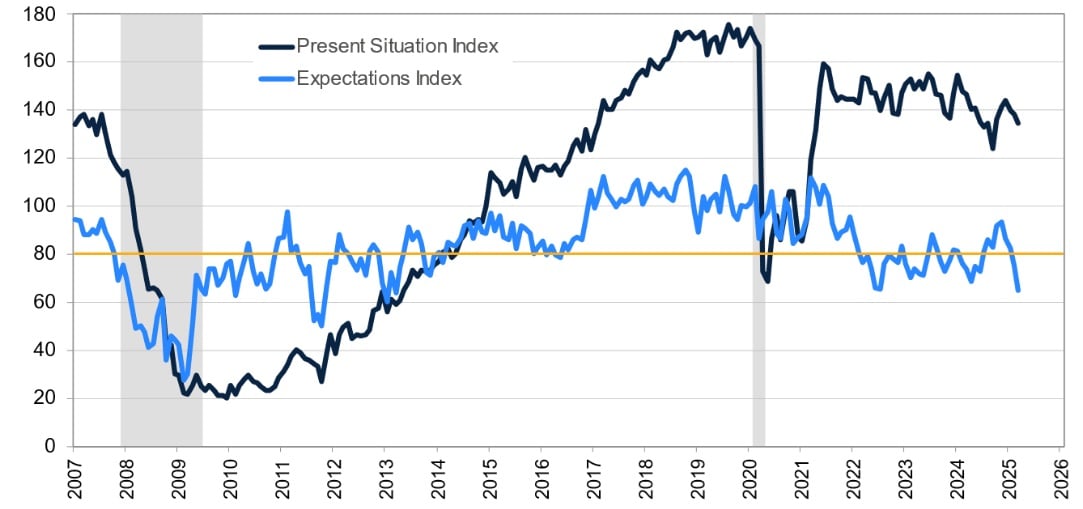

Conference Board Expectations Index flashing recession warning

Present Situation and Expectations Index, March 2025. Source: The Conference Board.

The Conference Board Expectations Index, a gauge of consumers’ short-term outlook for income, business, and labor market conditions, dropped 9.6 points to 65.2. That’s the lowest level in 12 years, “and well below the threshold of 80 that usually signals a recession ahead,” the group said.

“Mounting policy uncertainty has spooked consumers, signalling a pullback in spending,” forecasters at Pantheon Macroeconomics said in their March 26 U.S. Economic Monitor report. “But a consumer slowdown looks more likely than an imminent recession.”

Worries about the Trump administration’s threatened tariffs “clearly are a major factor behind the deterioration in confidence and have pushed up inflation expectations, too,” Pantheon forecasters said.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter