Japanese venture capital firm BeyondNext Ventures, which focuses on deeptech and deep science startups, plans to raise a $50 million fund to back more Indian ventures, a top company executive said.

The firm’s rationale is threefold: investing in companies with a strong go-to-market focus, investing in Indians across the world, and bringing these businesses to Japan, where larger conglomerates can act as distribution partners.

“We think of India as a place where there are enormous tailwinds and tonnes of young entrepreneurs,” Jay Krishnan, head of India investments at BeyondNext Ventures, told Mint in an interview. “We want to enable those tailwinds, both from a policy and risk conversion side, and bring them to Japan.”

BeyondNext entered India in 2019, when it backed 14 startups using capital from its $100 million second fund.

“Back then, the idea was to get a taste, get some exposure. Now, we’ve decided to go full hog in India,” Krishnan said.

Japanese VCs are looking more closely at the Indian startup ecosystem. Clean energy startup Aerem raised about $12 million from Sumitomo Mitsui Banking Corporation earlier this year. In November last year, Sumitomo’s Asia fund was part of a $35 million funding round in mortgage-tech startup Easy.

In July last year, mobility manufacturer Suzuki launched its first India-focused ₹340 crore fund to tap startups working in agriculture, financial inclusion, supply chain and mobility.

BeyondNext is fundraising at the moment and will set aside 50% of the fund for 20 to 25 investments in the first five years of the 10-year fund. In the next five years, it will deploy the remaining capital for winners from the India portfolio, reserving $1 million for a pre-Series A cheque and another $1 million for follow-on investments.

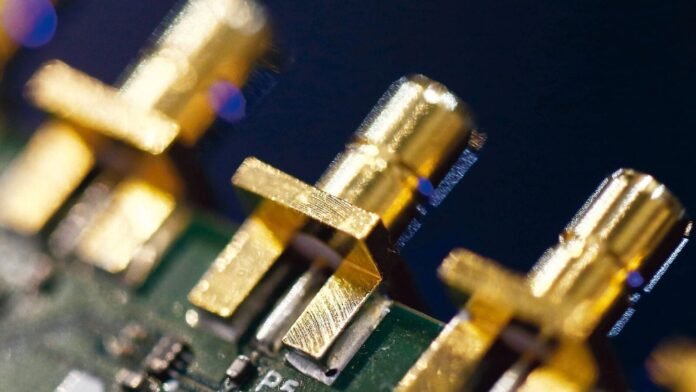

Bullish on semiconductors

The firm will enter companies at the pre-seed stage and is offering cheques that start at $250,000 and go up to $2 million.

“We don’t want to do Series A for these startups – we’d rather make them discoverable and visible to investors who come in at that stage,” said Krishnan.

For the India-focused fund, BeyondNext said it is very bullish on the semiconductor industry, specifically startups that are able to disrupt the value chain in the sector. Additionally, the firm is evaluating startups in biotech, space and artificial intelligence.

“We’re also eager about anything that has a local/contextualised play where the market is big enough that once they crack India, they can go anywhere,” Krishnan said.

The firm plans to bring its Japanese deeptech playbook to India. BeyondNext runs an incubation programme called BRAVE, where it matches scientists and researchers with ideas that could become startups with business-facing talent. The programme has yielded 52 ventures, according to BeyondNext’s website.

“We prefer two or three founders where the shortcomings of one are mitigated by someone else,” said Krishnan.

Some of BeyondNext’s previous investments in India include GigIndia, which was acquired by PhonePe in 2022, medical crowdfunding platform ImpactGuru, daycare surgery aggregator Medfin, and low-code digital therapeutics SaaS platform Wellthy Therapeutics.