Stay updated with complimentary notifications

Just register for the myFT Digest — delivered straight to your inbox.

US stocks reached a new closing high on Friday, marking a remarkable recovery from a sell-off triggered by initial tariff announcements in April.

Wall Street’s S&P 500 finished up 0.5 percent, even as trade discussions with Canada were paused. The index had previously risen as much as 0.8 percent, achieving a new intraday record peak for the first time since February.

A ceasefire facilitated by the US in the Israel-Iran conflict has positively impacted equities throughout the week, alleviating worries about potential disruptions to oil exports from the Middle East. Additionally, the US and China reportedly have reached a trade truce.

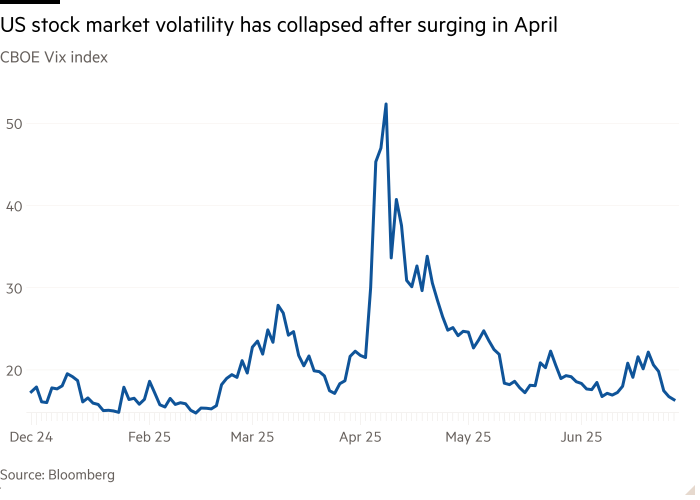

The S&P 500 has surged 27 percent since a 15-month intraday low on April 7, following the announcement of “reciprocal tariff” plans. These levies sparked considerable volatility in financial markets, leading to downgraded global economic growth forecasts.

However, Trump’s subsequent postponement of some tariff plans, along with a series of retreats from his more aggressive threats and comparatively strong economic data, have fueled a quick recovery for stocks.

Investors noted that this week’s stock rally was also enhanced by the potential elimination of a clause in Trump’s budget proposal that would empower the administration to raise taxes on foreign investments.

“The peak trade uncertainty is behind us, and [the US economy] remains resilient, refocusing on AI and growth,” remarked Venu Krishna, head of US equity strategy at Barclays. Citi’s leading US equity strategist Scott Chronert anticipates the S&P 500 will increase another 2.5 percent by the end of 2025.

The stock rebound stands in contrast to the ongoing pressure on US Treasuries and the US dollar, which fell to a three-year low this week due to concerns over the viability of the nation’s mounting debt.

Indicators of consumer and business confidence have been impacted by erratic tariff announcements affecting various products, but solid earnings from major companies and indications that Trump’s aggressive trade tactics have yet to reignite inflation or disrupt the job market have supported equities.

A wave of stock buybacks and strong retail investor interest have further propelled the recent rally. Analysts predict that Trump’s significant tax reforms will stimulate economic growth and enhance corporate profits.

“No matter what happens with tariffs, the market seems to perceive them as old news,” commented Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management.

“The market does not discount the same event twice. There are ‘growth fears’ and we move on.”

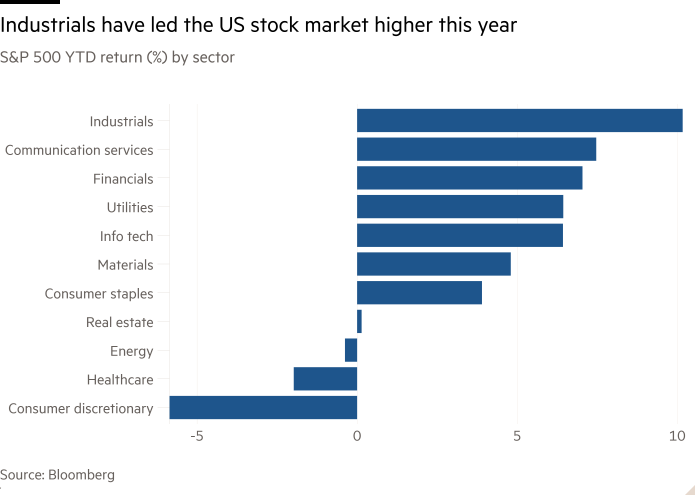

Tech stocks, which faced challenges early this year, have emerged as top performers since Trump’s tariff reversal on April 9. Shares of analytical software firm Palantir have surged 69 percent, online broker Robinhood has risen 144 percent, and server manufacturer Super Micro Computer has increased 50 percent. “Big Tech led the earlier sell-off and is now driving the rebound,” explained Krishna.

Industrial stocks have also shown significant gains in 2025. Howmet Aerospace is up 69 percent, while Uber and GE Vernova have each increased over 50 percent, placing them among the best-performing stocks in their sector this year. Defence companies RTX and tractor manufacturer Deere have seen upticks of 25 percent and 23 percent, respectively.

Nevertheless, some bearish analysts argue that the stock market’s upward momentum is built on unstable grounds, cautioning that the slowing growth in bank lending and rising credit card delinquencies suggest a downturn in economic growth.

“While ‘peak pessimism’ might be in our past, we believe we haven’t returned to the conditions enjoyed in January,” Shalett noted in an email to clients, adding, “the overall US stock market is even pricier based on forward earnings” than at the year’s start.