The analyst sees these two stocks as promising near-term picks based on technical indicators and breakout signals.

Raymond Lifestyle and Aditya Birla Sun Life AMC have seen strong gains in June. Raymond Lifestyle has surged 27%, while Aditya Birla Sun Life has gained over 10% in the last one month.

SEBI-registered analyst Sameer Pande has flagged these two stocks for upside potential in the near term.

1. Raymond Lifestyle

Raymond Lifestyle shares surged over 10% on Monday, a day ahead of the listing of its real estate arm, Raymond Realty. Following the demerger of its real estate subsidiary Raymond Realty, Raymond shares began trading ex-demerger from its real estate arm on May 14.

Chairman Gautam Singhania announced that Raymond Realty is expected to list in early July. Shareholders will receive one Raymond Realty share for each Raymond share they own.

On the technicals, he observed that the stock was showing extraordinary positive momentum on its daily chart. It broke past the first resistance of around ₹1,200. Additionally, the Relative Strength Index (RSI) is trading around 80, and over the last three trading sessions, the stock has shown extraordinary volumes.

Pande advised that traders who have missed this rally can enter around ₹1,260-₹1,300.

On the weekly charts, he sees a supertrend breakout; however, since the RSI is around 52, the stock may retrace to around ₹1,260-₹1,300 levels. Short-term investors can go long around these levels.

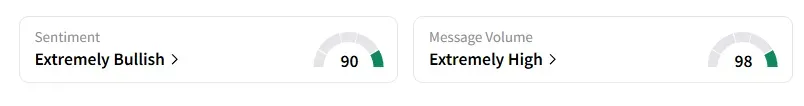

Data on Stocktwits shows that retail sentiment is ‘extremely bullish’ amid very high message volumes.

Raymond Lifestyle shares have fallen 36% year-to-date (YTD).

2. Aditya Birla Sun Life AMC

Aditya Birla Sun Life AMC shares have rallied over 10% in June. Pande noted that the stock has shown a positive breakout on Supertrend, followed by RSI above 60 levels, indicating robust investor confidence in the stock.

He believes that the stock may face resistance around the ₹850-₹870 levels, with support seen at the ₹750-₹720 levels.

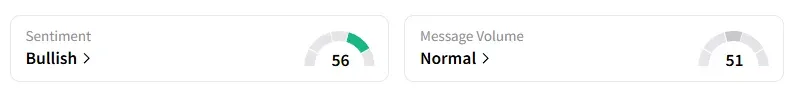

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Raymond Lifestyle shares have fallen 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.