While only 1 in 4 Americans surveyed last month by Fannie Mae said its was a good time to buy, that’s up from an all time low of 14 percent last spring.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

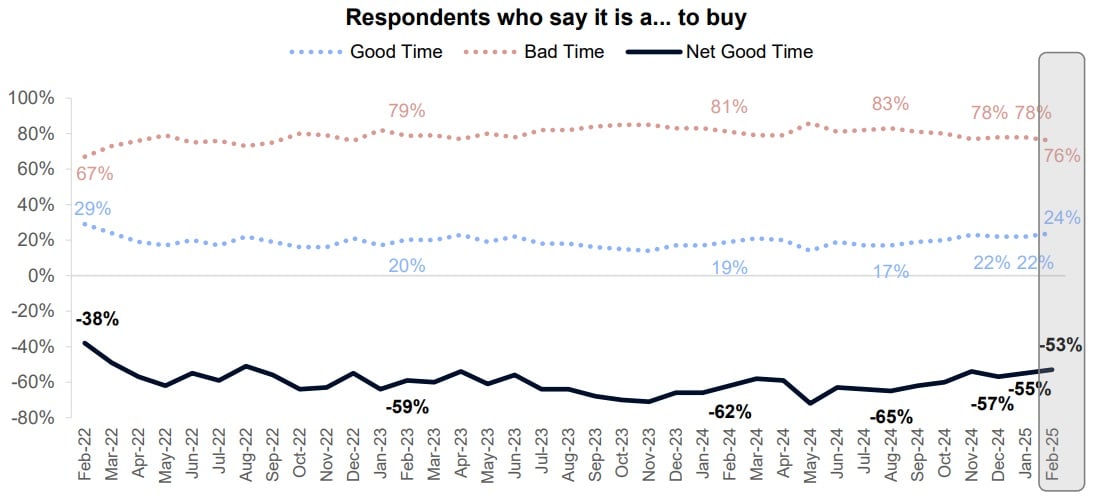

The vast majority of Americans still think it’s a bad time to buy a home, but the share of those who disagree is gradually inching up, according to a monthly survey of consumers by mortgage giant Fannie Mae.

While only 24 percent of homeowners and renters surveyed last month said February was a good time to buy, that’s up from 22 percent in January and 14 percent last May, which represented an all-time low in surveys dating to 2010.

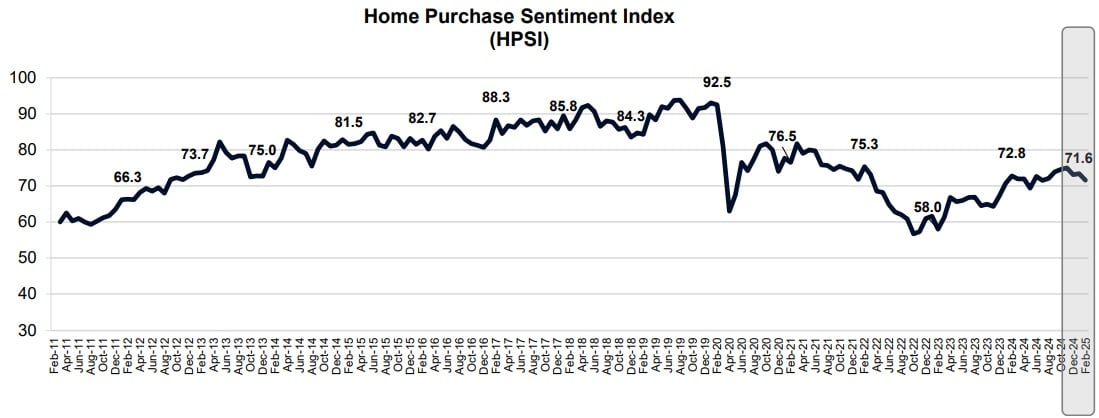

The bad news is that five out of six components of Fannie Mae’s Home Purchase Sentiment Index (HPSI) registered an increase in pessimism from January to February. The HPSI fell to 71.6 in February, down 1.8 points from January, posting the first year-over-year decline since 2023.

Most of the decline was attributable to the shrinking share of consumers who expect mortgage rates to fall in the next 12 months, Fannie Mae Chief Economist Mark Palim said.

“This growing pessimism makes sense, as mortgage rates had remained near the 7 percent threshold for a few months, including when we fielded this survey,” Palim said in a statement. “The decline in sentiment was further impacted by consumers’ growing concerns about their own personal financial situations.

Source: Fannie Mae National Housing Survey, February 2025.

Only 30 percent of the 1,066 household financial decision makers surveyed by Fannie Mae between Feb. 1 and Feb. 18 expected mortgage rates to go down in the year ahead, down from 35 percent in January.

With 33 percent expecting rates to go up and 36 percent that they’ll stay the same, the net share who expected rates to decline shrank by 6 percentage points from January, to negative 3 percent.

Source: Fannie Mae National Housing Survey, February 2025.

With the share of Americans who said February was a good time time to buy climbing past last year’s high of 23 percent, the share who say it’s a bad time to buy has pulled back from 86 percent last May to 76 percent in February. The net share of those who said it was a good time to buy increased 2 percentage points from January to February, to negative 53 percent.

Mark Palim

“While some consumers may be slowly acclimating to the higher mortgage rate environment, the vast majority continue to believe it is a ‘bad time’ to buy a home – with high home prices cited as the primary sticking point,” Palim said. “We continue to expect home sales activity to remain relatively light over our forecast horizon due to the ongoing lack of supply and overall unaffordability.”

In their February forecast, Fannie Mae economists predicted rates on 30-year fixed-rate mortgages won’t drop below 6.5 percent this year or next, and that sales of existing homes will rebound by just 2.9 percent from last year, the slowest year for sales since 1995.

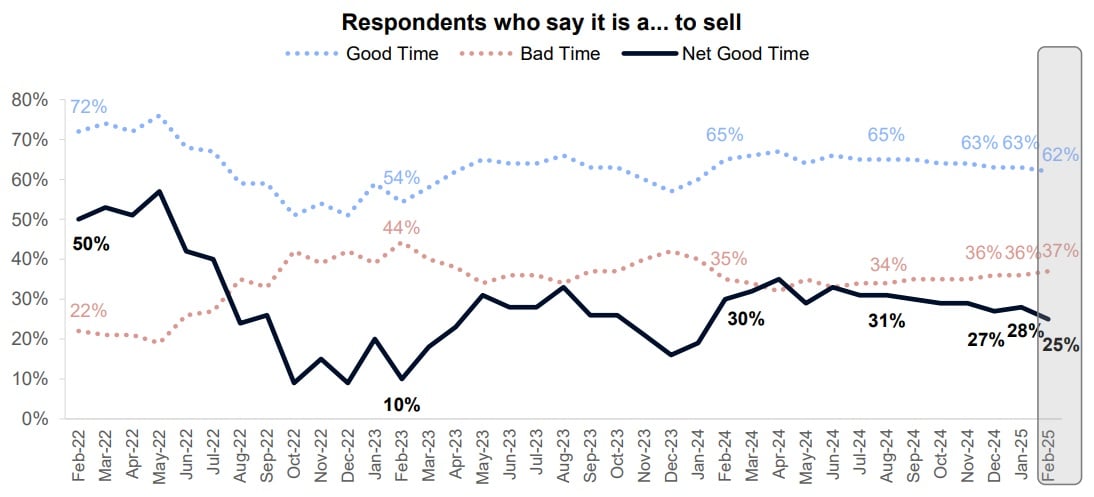

Source: Fannie Mae National Housing Survey, February 2025.

Better conditions for buyers usually come at the expense of sellers, and the percentage of consumers who thought February was a bad time to sell was up 1 percentage point from January and 5 percentage points from April, to 37 percent. But 62 percent still thought February was a good time to sell, down from 67 percent in April.

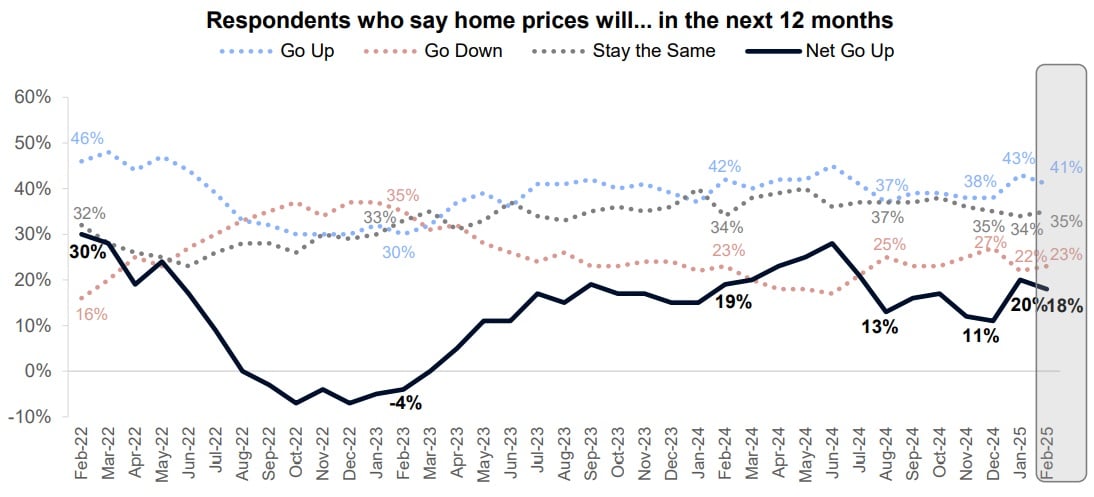

Source: Fannie Mae National Housing Survey, February 2025.

While most Americans surveyed in February thought home prices will either stay the same (35 percent) or go down (23 percent), 41 percent expect them to go up in the year ahead.

Although falling home prices might be good news for would-be homebuyers, Fannie Mae considers that a negative in calculating the HPSI because it signals consumers believe homes are overvalued.

Source: Fannie Mae National Housing Survey, February 2025.

The other HPSI components that turned more pessimistic from January and Febrary were change in household income and job loss concerns.

The net share of Americans who said their household income was significantly higher than it was 12 months ago decreased 1 percentage point from January to February, to 7 percent.

While only 23 percent of household financial decision makers said they were concerned about losing their jobs in the year ahead, that was up by a percentage point from January.

While the HPSI in February posted its first year-over-year decline in nearly 2 years, it remains well above an all-time low of 56.7 registered in October 2022.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter