Bigger. Better. Bolder. Inman Connect is heading to San Diego. Join thousands of real estate pros, connect with the power of the Inman Community, and gain insights from hundreds of leading minds shaping the industry. If you’re ready to grow your business and invest in yourself, this is where you need to be. Go BIG in San Diego!

Tech-driven mortgage lender Better continues to inch toward profitability as its booming business in home equity products and mortgage refinancing helped the company grow 2024 funded loan volume for the first time in three years even as it slashed expenses.

TAKE THE INMAN INTEL INDEX SURVEY FOR MARCH

At $936 million, Q4 2024 loan funding was up 77 percent from a year ago, as Better continued to ramp up its use of AI to slash the cost of funding each loan.

Better’s automated “One Day Mortgage” product represented 73 percent of all direct-to-consumer lending in Q4, helping the company achieve loan fulfillment costs it says are 35 percent lower than the industry average of $9,000 per loan.

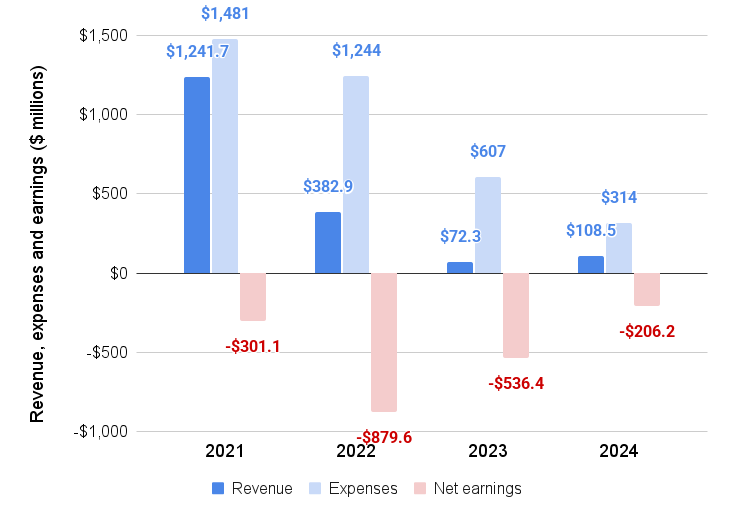

Although parent company Better Home & Finance Holding Co. reported a $59 million Q4 net loss and a $206 million loss for the year Tuesday, CEO Vishal Garg was optimistic about the company’s direction on a call with investment analysts Wednesday.

“We went into 2024 with the goal of leaning into growth and AI to drive increased volume and revenue, balanced with ongoing efficiency improvements, diversification of our distribution channels and corporate cost reductions,” Garg said. “We executed against these objectives,” boosting full year funded loan volume by 19 percent and revenue by 50 percent, while trimming the company’s annual net loss by 61 percent.

Shares in Better, which during the last 12 months have traded for as much as $30 and as little as $7.71, closed at $11.50 Tuesday before earnings were released after hours. After briefly dropping to $10 Wednesday, shares in Better were back in positive territory in afternoon trading following Wednesday’s investor call.

A rebound from 2023 bottom

Source: Better Home & Finance Holding Co. regulatory filings.

After originating $58 billion in mortgages in 2021 as mortgage rates hit historic lows during the pandemic, Better downsized dramatically when rising mortgage rates put an end to the refinancing boom.

The New York-based lender — which also has offices in Charlotte, North Carolina; Irvine, California; Troy, Michigan; Irving, Texas; and Gurgaon, India — finished 2024 with about 1,250 employees, down 88 percent team from a Q4 2021 peak of 10,400, according to its annual report to investors.

At $3.59 billion, Better’s 2024 funded loan volume was up 19 percent — the first annual growth since 2021. The number of loans funded grew by 37 percent, to 11,755 as the company closed more home equity loans with smaller balances.

Better executives said their AI agent, Betty, which is programmed to make or take calls from consumers, is handling 115,000 customer interactions a month and has the potential to drive costs per loan down by another $2,000.

By the end of the year, Better informed investors that it expects Betsy “to be capable of completing most functions currently done by a loan officer, allowing our human LOs to focus on customer care and issue resolution.”

Garg shared an audio demo of Betsy helping a client take out a home equity line of credit (HELOC), “all the way through mortgage rate lock, which would traditionally have involved separate conversations with up to three sales team members and multiple phases of manual data entry.”

“What differentiates Betsy from other AI bots that you might have seen across financial services is this is not just an FAQ bot or an appointment scheduler,” Garg said. “We have seen other mortgage companies utilize those bots, which typically perform a single function and interact with users only over chat.”

Other lenders often employ seven or eight legacy software systems, limiting the usefulness of AI agents that only connect to one. Garg said Betsy connects to Better’s “Tinman” technology stack — an end-to-end point-of-sale, CRM, pricing, eligibility and loan origination engine that also handles appraisal management, quality control and closings.

“Everything that our loan teams do is captured on this platform,” Garg said.

Better’s One Day Mortgage product is also enabled by Tinman, which was able to employ AI review and instant underwriting of 40 percent of loan files in March — potentially driving $1,400 in fulfillment cost savings per loan, the company said.

Tinman is now capable of handling “a much broader set of products,” including non-conforming, home equity products, and FHA and VA mortgages, “a key area of growth for us,” the company said.

Better estimates it could boost annual loan production by $7 billion if it’s able to bring its market share for those products up to the 0.64 percent market share it achieved last year for conforming mortgages that are eligible for purchase by Fannie Mae and Freddie Mac.

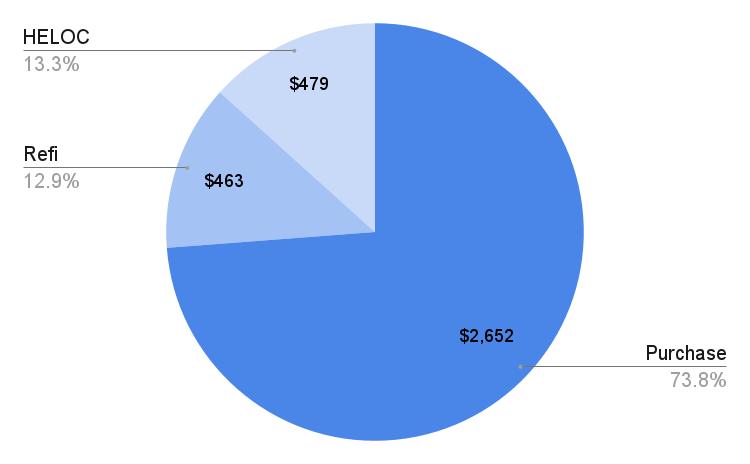

HELOC, refi growth offset drop in purchase lending

At $2.65 billion, purchase mortgages accounted for nearly 74 percent of Better’s business last year.

While purchase mortgage volume was down 3 percent from $2.74 billion in 2023, growth in home equity products (HELOCs and closed-end second-lien loans) and refinancing more than made up the difference.

At $479 million, 2024 home equity funding volume was up 86 percent from a year ago, while refinancing volume grew by 56 percent, to $463 million.

Last month Better boasted that it had quadrupled HELOC and home equity loan production from $15 million per month in January 2024 to $60 million per month in October 2024.

“This acceleration establishes Better as the fastest-growing digital home equity lender in the market,” the company claimed at the time.

In February, the company announced a “Better Forever” loyalty program aimed at boosting repeat business by waiving Better’s $995 origination fee when previous customers refinance or take out another purchase loan.

But 2025 got off to a rocky start when one of Better’s biggest partners — Detroit-based Ally Financial Inc. — announced in January that it was laying off hundreds of employees and getting out of the mortgage business.

Ally originated $1 billion in mortgages in 2023 through its partnership with Better and is also an investor in the company, which went public in a 2023 special purpose acquisition company (SPAC) merger.

While Better once relied on its business-to-business (B2B) partnerships for nearly half of its business, the partner channel accounted for only 19 percent of Q4 2024 loan volume.

Going forward, Better plans to grow its partner channel by offering its technology through co-branded or white-label solutions.

In November, Better announced a partnership with NEO Home Loans to use Better’s Tinman technology stack to power local loan officers.

Better hired NEO Home Loans executives Ryan Grant and Danny Horanyi to lead the “NEO Powered by Better” partnership and build out a distributed retail channel.

During the fourth quarter, Better says it onboarded 110 NEO loan officers who work out of 53 branch offices, and that since January NEO Powered by Better has originated 220 loans totaling $95 million.

Revenue, expenses, earnings move in right direction

Better inched toward profitability in 2024 by not only cutting expenses for the third consecutive year but growing revenue.

At $314 million, Better slashed 2024 expenses by 48 percent from a year ago, with compensation and benefits costs down 22 percent, to $141 million.

Intent on growing loan volume, Better boosted spending on marketing and advertising at the end of Q1 2024, driving up expenses for the year by 74 percent, to $34 million.

While expenses were essentially flat from Q3 to Q4, Better recognized $17 million in restructuring expenses in the final three months of the year that were attributed primarily to the wind-down of three businesses it operated in the United Kingdom.

Better expanded its U.K. operations by acquiring two internet-enabled real estate finance businesses in 2021, followed by the 2023 acquisition of Birmingham Bank.

“We are undergoing efforts to exit non-core U.K. assets while continuing to focus on growing the Bank of Birmingham,” the company said. “We are in active disposition on three smaller U.K. businesses, and expect adjusted EBITDA [earnings before interest, taxes, depreciation and amortization] loss to improve starting in the second half of 2025 as a result of these dispositions.”

Better’s board of directors in January approved a $25 million share repurchase program — a move that typically means company executives think shares are undervalued.

In a March 17 regulatory filing, Better announced that a longtime board member, Riaz Valani, had resigned on March 11. But Better said Valani — who last year reported owning more than 10 percent of the company — resigned due to conflicting time commitments, and “not due to any disagreements with the company.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter