The cloud banking software provider is finishing up the year with a bang, announcing a partnership with a leading loan servicer and recruiting PlanSource veteran Srini Venkatramani as the company’s new head of product.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Cloud banking software provider Blend Labs Inc. is finishing up the year with a bang, announcing a partnership with PHH Mortgage and recruiting IBM and PlanSource veteran Srini Venkatramani as the company’s new head of product.

Nima Ghamsari

“With his leadership experience in product and technology and a track record of driving value creation for SaaS businesses, Srini will be invaluable as we continue our evolution into a platform-first company,” Blend co-founder and CEO Nima Ghamsari said in a statement. “With his expertise, we’ll be well-positioned to help our customers leverage Blend’s technology to unlock new opportunities and deliver even greater ROI.”

Erik Wrobel, who has served as Blend’s head of product for five years, will depart the company at the end of the year.

Ghamsari thanked Wrobel “for his outstanding product leadership over the past five years. He has had a remarkable career here at Blend, and we wish him the best in his next chapter.”

As head of product, technology, and customer operations Venkatramani will be responsible for Blend’s product vision, technology strategy, and operational excellence, the company said.

Srini Venkatramani

“Blend’s culture is obsessively customer-centric, and it clearly radiates through the team’s passion for building impactful technology,” Venkatramani said in a statement. “I look forward to contributing my expertise and taking Blend into its next phase of growth as the industry’s most digitally robust, efficient, and powerful origination platform.”

Based in San Francisco, Blend’s technology is used by 20 of the top 50 mortgage lenders. With elevated mortgage rates crimping the business of its clients, Blend laid off 50 workers in September — about 9 percent of its employees — as part of a workforce reduction plan it expects to complete by the end of the year. The company is nearing profitability, trimming losses from $19.2 million in the second quarter to $2.6 million in Q3.

In October, Blend announced a multi-year mortgage and home equity deal with Pentagon Federal Credit Union (PenFed), the nation’s second-largest credit union with 2.8 million members. With that partnership, Blend said it provides services to seven of the top 10 credit unions.

Colin Friday

“By partnering with Blend, we’re embracing advanced automation and digital capabilities that not only eliminate inefficiencies but also allow us to focus on what truly matters — helping our customers achieve their homeownership dreams,” PHH Mortgage executive Colin Friday said, in a statement.

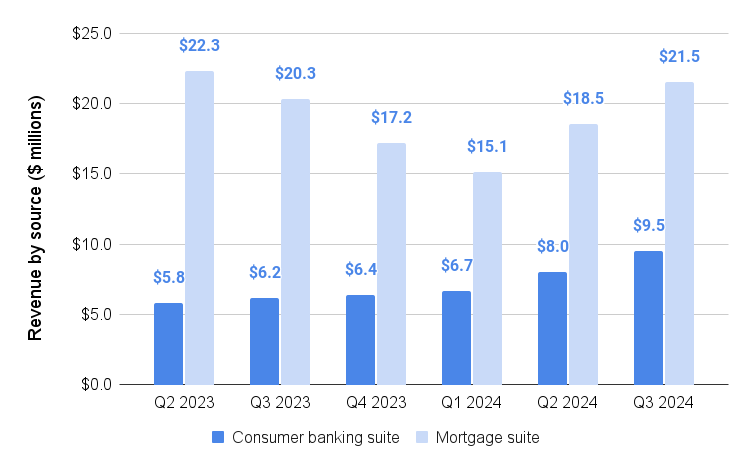

Although most of Blend’s revenue comes from the services it provides to mortgage lenders, it offers a suite of tools that help banks process applications for vehicle loans, personal loans, credit cards, and deposit accounts.

Blend revenue by source

Blend said Q3 revenue from its consumer banking business was up 53 percent from a year ago, to $9.5 million, and that it signed a deal to power credit cards, auto, and personal loans for a top 300 financial institution.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter