It took just a few hours for Friedrich Merz to conduct one of the sharpest U-turns in recent political history.

At lunchtime last Friday, Germany’s chancellor-to-be received a sobering briefing on the state of the economy from finance minister Jörg Kukies.

Kukies explained that after two years of stagnation and with more clouds gathering over Europe’s largest economy, Berlin faced a €130bn budget shortfall over four years and dwindling growth potential, according to people with knowledge of the presentation.

Shortly afterwards, Donald Trump had a public shouting match in the Oval Office with Volodymyr Zelenskyy, accusing the Ukrainian leader of not wanting peace with Russia, Kyiv’s aggressor, and not being grateful for Washington’s support. For Washington’s allies in Europe, the extraordinary scenes were further evidence that the Trump administration had turned hostile.

Watching all this unfold, Merz decided “there was no time to lose”, says a person close to his thinking.

Within days, the centre-right leader of the Christian Democratic Union (CDU) struck a deal with the Social Democratic party (SPD), his likely coalition partner in the next government, which would transform the way Germany manages its economy.

The two parties agreed to loosen the country’s constitutional debt brake and inject hundreds of billions into Germany’s military and ageing infrastructure — a breakthrough upending more than two decades of conservative fiscal dogma.

Under the agreement, which still has to be approved by parliament with a two-thirds majority, Berlin would be able to raise as much debt as needed to equip the Bundeswehr. In return for its support on defence, the SPD secured the creation of a €500bn, 10-year infrastructure fund to modernise the country’s roads, bridges, energy and communications networks — one of the party’s flagship campaign pledges.

It was time to adopt a “whatever it takes” approach to defence in light of the “threats to freedom and peace” in Europe, Merz said on Tuesday when he announced the deal alongside the leaders of his Bavarian sister party CSU and the SPD.

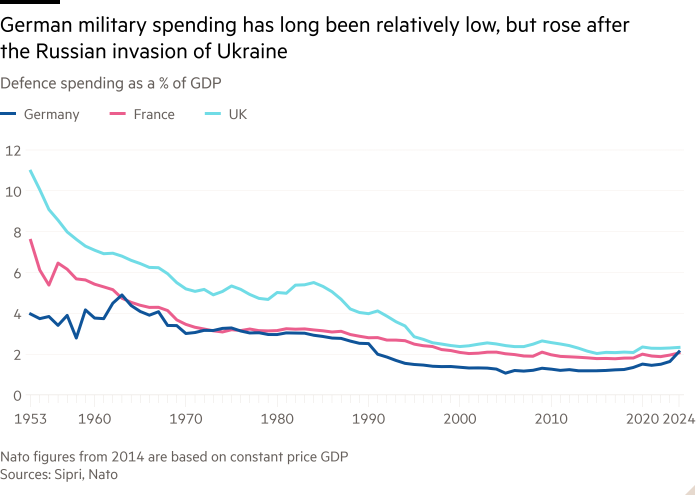

Not only does the agreement represent a stark departure from the brand of economic orthodoxy that has been dominant in Germany, it also accelerates a move away from decades of military restraint after the second world war.

“It is a huge shift away from this stance of ‘You make do with the money you’ve got, rather than borrow’ that has been the pillar of the modern German economy, and has been something Germans have really prided themselves in,” says historian Katja Hoyer.

“It signals that Germany is going to play a bigger role on the world stage, but also that Germany will look more after its own interests.”

The prospect of huge investments into the defence sector has also fuelled hopes Germany could halt its industrial and technological decline by helping manufacturers and engineers find a new purpose and new markets — with positive effects rippling through the Eurozone.

This is “one of the most important shifts in German economic policy” since the second world war, says Vikram Aggarwal, investment manager at Jupiter Fund Management, as Germany adapts to a “multipolar word” where countries and regions “will have to increasingly provide for their own defence”.

According to Joe Kaeser, former chief of German engineering giant Siemens, now chair of Siemens Energy and Daimler Truck: “It means we are going to be back, Germany — we don’t know exactly how, but this is what we are going to achieve.”

With potentially more than €1tn in additional debt over the next decade, economists have compared the fiscal stimulus to the country’s reunification in 1990, when the government led by CDU chancellor Helmut Kohl poured billions into the former eastern communist states.

The effects on Germany’s industry should be significant, economists, policymakers and business executives believe, as defence contractors help replace part of the shrinking automotive base and infrastructure projects jolt the construction sector back into life.

“One should not underestimate what confidence does on decision-making for investment and employment,” says Kaeser. “This [deal] is a priceless effort to set out a mission — to say this is what we’re going to do: this landing on the moon.”

BNP says that the announcement can deliver “a positive confidence shock”, galvanising consumers and companies. The German economy — stuck in a rut for the past two years — could expand 0.7 per cent as soon as 2025, compared to 0.2 per cent growth in a previous scenario, the bank estimates.

Economists predict the debt-to-GDP ratio, currently at 63 per cent, will still be far lower than that of France or Italy. While German stocks soared, the country’s borrowing costs, traditionally the lowest in the Eurozone, jumped by the most since the 1990s, as investors adjusted to Berlin’s newfound boldness.

The new package would accelerate industrial shifts already under way since outgoing chancellor Olaf Scholz set up a special €100bn military fund in 2022, in the wake of Russia’s full-scale invasion of Ukraine. At the time, he described the move as Zeitenwende — historic turning point — in his nation’s approach to defence and security. Germany is the second largest supplier of arms to Ukraine behind the US.

The race to re-arm could be a much-needed boost for German manufacturing, which has been hit by the crisis in carmaking, looming trade wars, and growing competition from cheap Chinese steel and car imports.

German weapons maker Rheinmetall, whose stock has nearly doubled this year, is converting some of its own domestic car-part plants to produce military equipment. Last month Franco-German tank maker KNDS agreed to take over and convert a train-making factory from Alstom in the eastern town of Görlitz to produce parts for battle tanks and other military vehicles.

Hensoldt, a state-owned maker of sensors and radars, is in talks to hire teams of software engineers from Continental and Bosch, two of Germany’s largest automotive suppliers, which together have announced over 10,000 job cuts in the past year.

Excitement spread among Deutsche Bahn staff this week, at the thought that the state-owned railway known for its delayed trains and signalling failures would receive the money to implement a €53bn renovation plan stuck in limbo since the collapse of Scholz’s coalition in November.

Boris Pistorius, SPD defence minister, has been one of the most vocal advocates for debt brake reform. German’s most popular politician, who hopes to remain in his post under a Merz-led coalition, described this week’s announcement as “a truly far-reaching, historic decision”, saying: “We are taking responsibility for our security not only as Germany, but also for our Nato partners.”

That Merz, of all German politicians, would orchestrate such a dramatic policy shift, has startled many in Germany. A staunch Atlanticist in the tradition of postwar chancellor Konrad Adenauer, the 69-year-old former BlackRock senior adviser has built a reputation as a supply-side conservative sceptical of state intervention.

During the campaign, he vowed to cut taxes, regulation and welfare benefits. While he did not rule out a reform of the borrowing limits, he insisted that budget priorities first be set and cuts decided.

“It’s a typical ‘Nixon-goes-to-China’ moment,” says a person close to the negotiations.

“You don’t choose the historic moments in which you live,” says Sophia Besch, senior fellow in the Europe Program at the Washington-based Carnegie Endowment for International Peace. “Merz, as a transatlantacist, would not have chosen to be the chancellor overseeing the divorce with the US.”