Beijing has responded to Donald Trump’s tariffs on imports from China by imposing duties of its own but has restricted their scope in a potential effort to avoid a full-scale trade war.

The new measures target a variety of US products, including liquefied natural gas and automobiles, and are set to go into effect on February 10. They were announced shortly after the US president implemented an additional 10% tariff on Chinese goods.

In addition, Beijing announced an antitrust investigation into Google, whose search engine is not accessible in China.

These latest tariffs from Beijing cover approximately $14 billion worth of goods, according to Citigroup analysts, representing less than 10% of total US imports in 2023.

Chris Beddor, deputy China research director at Gavekal, described the move as a “non-escalatory response” aimed at fostering negotiations and reaching a deal.

While Trump’s recent levies on Canada, Mexico, and China sparked concern among allies and investors, Beijing has taken steps to address the opioid fentanyl issue, a point of contention for the US administration.

Despite initial threats of higher tariffs, Trump has not yet imposed the 60% levy on Chinese exports, indicating a desire to reach a deal with Beijing.

The trading relationship between the US and China has significantly influenced both economies in recent years. Beijing’s share of US imports has decreased notably since the introduction of tariffs by Trump during his first term.

China’s retaliatory measures include tariffs ranging from 10% to 15% on various US products, such as LNG, coal, crude oil, and farm equipment, as well as additional export controls on rare metals and car imports from the US.

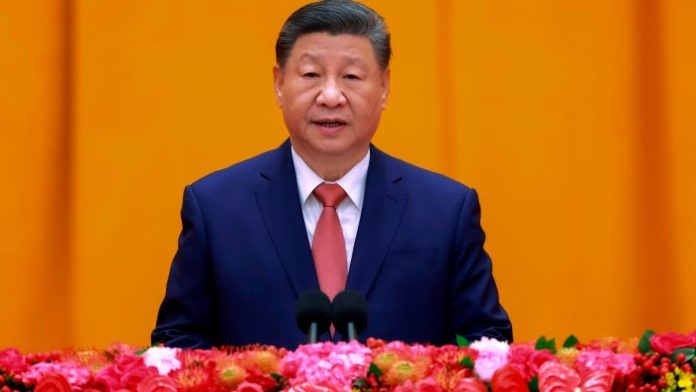

Hopes are high for a resolution as Trump is expected to engage in talks with Xi soon to avert a full-blown trade conflict between the two largest economies.

In response to China’s actions, the White House highlighted President Trump’s commitment to national security and safety in combatting the flow of fentanyl from China.

…