Recent surveys indicate that Americans are increasingly worried about the potential for an economic slowdown combined with rising inflation.

Real estate is evolving rapidly, and it’s essential to adapt. Inman Connect San Diego is your destination to transform uncertainty into actionable strategies—featuring genuine discussions and critical connections. If you want to stay ahead, this event is a must. Register now!

Ongoing uncertainty regarding tariffs under the current administration continues to dampen consumer confidence, as indicated by key surveys.

The latest University of Michigan consumer sentiment data released recently shows that consumer sentiment improved for the first time in six months in June, marking a 16 percent increase from May.

University of Michigan Index of Consumer Sentiment

However, with an index value of 60.7 in June, down 18 percent from December 2024, “consumer perceptions are generally in line with an anticipated economic slowdown and rising inflation,” stated survey director Joanne Hsu.

Joanne Hsu

“Consumers remain apprehensive about the potential tariffs, yet currently, they do not seem to associate events in the Middle East with economic implications,” Hsu noted.

Despite a surge in oil prices due to rising tensions with Iran earlier in June, prices have since declined as attacks by Israel and the U.S. did not trigger widespread conflict.

The Conference Board Consumer Confidence Index, published on June 24, fell by 5.4 points to 93. Previously, the index had registered its first increase in five months in May, with a rise of 12.3 points.

Stephanie Guichard

“Consumers frequently express concerns regarding tariffs, linking them to negative effects on the economy and pricing,” said Conference Board Senior Economist Stephanie Guichard in a statement. “Inflation and escalating costs were prominent issues of concern in June.”

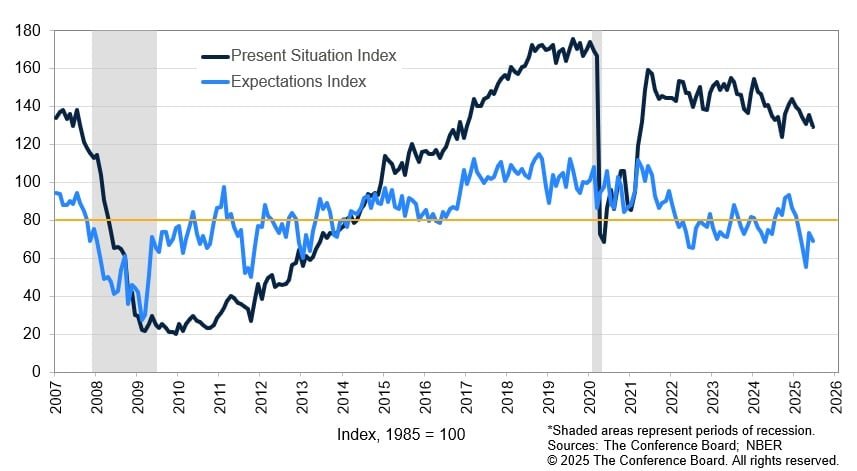

Conference Board Present Situation and Expectations Indexes

The Conference Board’s Expectations Index, which captures consumer outlook on income, business conditions, and employment, dropped 4.6 points to 69—significantly below the 80-point mark often indicating a potential recession.

Economists speculate that while tariffs may contribute to pricing inflation, they could simultaneously slow the economy if consumer spending decreases and hiring slows.

Federal Reserve policymakers have indicated intentions to reduce short-term interest rates twice this year to maintain low unemployment, while they monitor the impact of tariffs on pricing.

The latest figure for the Federal Reserve’s preferred inflation measurement, the personal consumption expenditures (PCE) index, revealed a decline of $29.3 billion in consumer spending in May, with the yearly inflation rate moving further from the Fed’s 2 percent target, now standing at 2.3 percent.

Ongoing tariff negotiations contribute to uncertainty, as many country-specific “reciprocal tariffs” have been pushed back from an original implementation date in April to July 9.

U.S. stock indexes reached new record highs on Friday on reports of a potential trade deal between the U.S. and China, but reversed course following President Trump’s announcement of halting trade discussions with Canada.

Currently, consumers are facing an average effective tariff rate of 15.8 percent on imports—the highest level since 1936, based on a June 17 analysis from The Budget Lab at Yale.

Stay updated with Inman’s Mortgage Brief Newsletter delivered directly to your inbox every Wednesday, providing a weekly overview of significant news in mortgages and closings. Click here to subscribe.

Email Matt Carter