Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It is hard to talk about 21st-century economic history without discussing the “China shock”. That is the term often used to describe China’s entrance into the global market, a change that brought rich countries an abundance of cheap goods, but left entire industries and workforces mothballed.

DeepSeek may provide a sequel. A little-known Chinese hedge fund has thrown a grenade into the world of artificial intelligence with a large language model that, in effect, matches the market leader, Sam Altman’s OpenAI, at a fraction of the cost. And while OpenAI treats its models’ workings as proprietary, DeepSeek’s R1 wears its technical innards on the outside, making it attractive for developers to use and build on.

Things move faster in the AI age; terrifyingly so. Five of the biggest technology stocks geared to AI — chipmaker Nvidia and so-called hyperscalers Alphabet, Amazon, Microsoft and Meta Platforms — collectively shed almost $750bn of market value before US markets opened on Monday. It could be particularly grim for Nvidia if it proves true that DeepSeek won without the use of its shiniest chips.

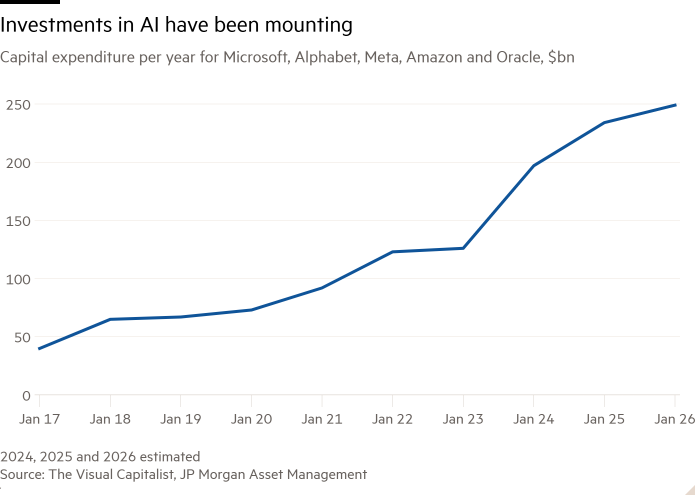

Investors in tech companies — including Europeans such as chipmaker ASML, and energy companies that investors hoped would get a boost from fuelling data centres — are left wondering whether their investments will go up in smoke. The hyperscalers were due to plough almost $300bn into capital expenditure this year, according to Visible Alpha estimates. Analysts expect that on Wednesday, when they report earnings, Meta and Microsoft will report investment for 2024 totaling $94bn.

In truth, the game is not over. DeepSeek’s actual potential is still unclear, and it has yet to achieve “artificial general intelligence”, the humanlike state that Meta and OpenAI are pursuing. But the rules might have changed. At the very least, DeepSeek may take some of the US giants’ customers. At worst, it has challenged the core belief that more hardware is the key to better AI. That principle has underpinned the market value of Silicon Valley companies as they invest hand over fist.

What is bad for the hyperscalers could still be a windfall for everyone else. For most business users, having the absolute best model is less important than having one that’s reliable and good enough. Not every driver needs a Ferrari. Advances in reasoning such as R1 could be a big step for “agents” that deal with customers and perform tasks in the workplace. If those are available more cheaply, corporate profitability should rise.

In that sense, this second China shock could resemble the first. It could bring not just destruction but a reshuffling — albeit a painful one for many. Researchers have estimated that for every job lost to the China shock, US households’ purchasing power rose by more than $400,000. The race for AI supremacy is on pause; the great giveaway has begun.