Two major threats facing the Eurozone economy in 2025 are a potential global trade war and regional political paralysis, as per a Financial Times survey of 72 economists.

Donald Trump, the president-elect of the US, has promised to impose tariffs of up to 20% on all US imports, with the rates increasing to 60% on China, once he resumes office on January 20.

If Trump follows through on his promise, these tariffs would mark the most significant spike in US protectionism since the Great Depression, potentially leading to retaliatory measures elsewhere.

The Eurozone, which boasts a substantial trade surplus with the US, faces the risk of both higher tariffs and the possibility of China flooding global markets with inexpensive goods in response to Trump’s actions.

According to Mujtaba Rahman, Managing Director for Europe at Eurasia Group, “Trump’s second term is now the primary political and economic concern. Europe could be hit by tariffs and pressure from Trump to sever ties with China.”

Most surveyed economists anticipate a trade conflict initiated by US tariffs: 69% consider it probable, with 68% identifying it as the greatest threat to the region next year.

A significant majority of respondents (81%) believe that a second term for Trump will impact Eurozone growth negatively.

Economists suggest that the repercussions of Trump’s trade policies could hinder economic output in Europe even before implementation. Tomasz Wieladek of T Rowe Price mentioned that the anticipation of Trump’s tariffs might discourage companies from making investments until some uncertainties are resolved.

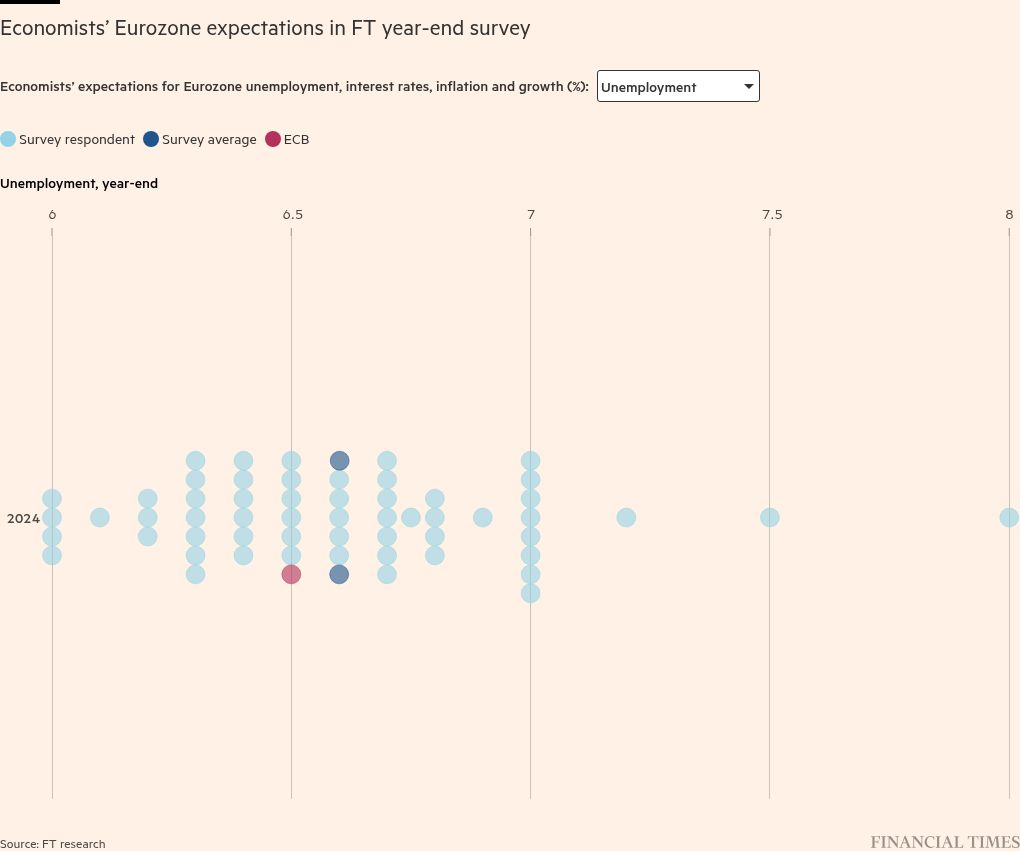

The surveyed economists expect the Eurozone economy to grow by a mere 0.9% on average, which would be the third consecutive year of subpar growth and below the 1.1% forecasted by the European Central Bank staff in December.

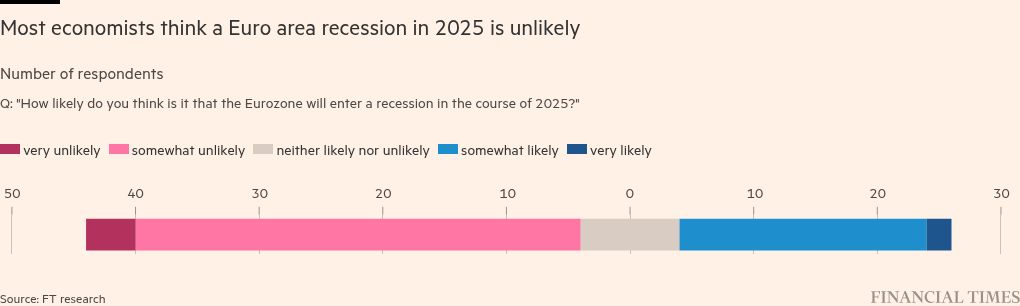

Nevertheless, there is a widespread belief that the Eurozone can evade a recession. John Llewellyn, a former senior economist at the OECD and Lehman Brothers, who is now a partner at Independent Economics, is the outlier predicting a 1% decline in the Eurozone economy next year.

Many economists (61%) support ECB president Christine Lagarde’s call for EU policymakers to engage in trade negotiations with Trump to prevent a full-fledged trade war.

On another note, a vocal minority believes that pursuing a trade agreement with the US might only provoke more aggressive actions. Kamil Kovar, a senior economist at Moody’s, described Trump as having the mindset of a playground bully.

Carsten Brzeski, the global head of macro at ING Bank, pointed out that in 2024, not only tariffs but also US tax cuts, deregulation, and lower energy prices pose threats to the European economy.

In addition to geopolitical risks, Europe’s inability to address internal issues is viewed as a significant risk by nearly a third of respondents.

Ulrich Kater, the chief economist at Germany’s Deka Bank, likened Europe to the late Habsburg empire, falling behind economically and technologically due to bureaucracy and a nostalgic fixation on past glory.

When asked about reasons for optimism, some economists cited declining interest rates and a potential increase in consumer demand. Others believe that Germany’s upcoming elections might lead to amendments in the nation’s stringent constitutional debt brake and bolster investments.

While a fifth of economists see potential benefits in the prevailing pessimism, anticipating it might prompt necessary reforms, others caution against anticipating significant positive changes from a new German government.

Additional reporting by Alexander Vladkov in Frankfurt

Data visualisation by Martin Stabe