Prepare yourself to take bold steps forward by refining your business model, mastering new technologies, and discovering strategies to capitalize on the next market surge at Inman Connect New York. Join us and thousands of real estate leaders from Jan. 22-24, 2025 as The Next Chapter is about to begin.

Investors celebrated an encouraging inflation report on Wednesday, leading to a sharp fall in mortgage rates and a surge in shares of publicly-traded lenders and real estate companies. This report increases the likelihood of more Federal Reserve rate cuts this year.

Following a strong jobs report on Jan. 10, discussions arose that the Fed might not cut rates until June. However, the latest Consumer Price Index numbers showed a 0.4 percent rise from November to December, with core inflation only increasing by 0.2 percent, surprising investors.

According to Pantheon Macroeconomics Chief U.S. Economist Samuel Tombs, the benign CPI report for December should dispel speculation that the Fed’s next move will be to tighten policy.

The CME FedWatch Tool indicated a 44 percent chance on Wednesday that the Fed will cut rates again in May. This led to a drop in yields on 10-year Treasury notes, prompting a decrease in mortgage rates tracked by Mortgage News Daily, with rates on 30-year fixed-rate home loans falling by 12 basis points to 7.13 percent.

Shares in mortgage lenders and real estate companies, influenced by interest rates, saw significant increases. Major banks like JPMorgan Chase, Wells Fargo, and Goldman Sachs posted positive fourth quarter earnings reports, causing a boost in share prices for companies like UWM, Rocket, RE/MAX, Anywhere Real Estate, and eXp World Holdings.

Mortgage rates, after hitting a low in 2024, have climbed by a full percentage point due to concerns about inflation. The Federal Reserve’s rate cuts in late 2024 did not fully alleviate these concerns, leading to predictions of more rate cuts in 2025 from Pantheon Macroeconomics.

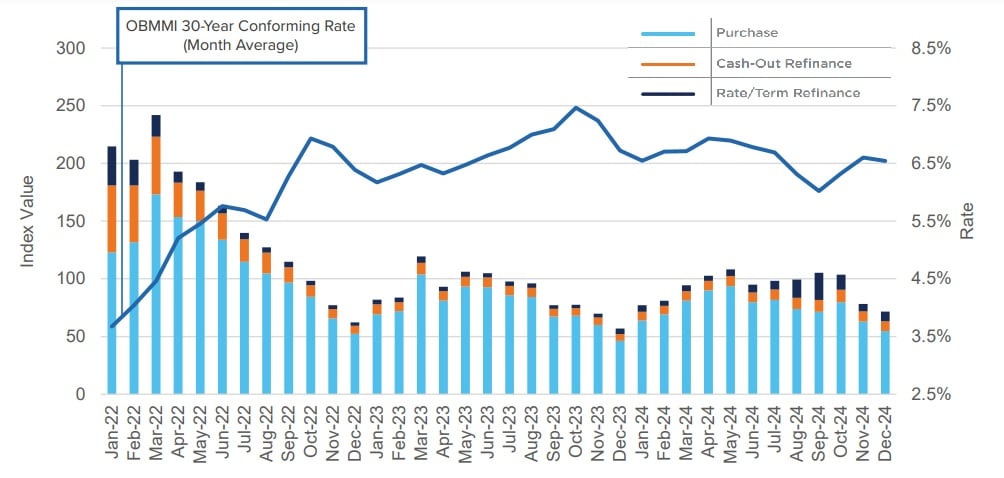

Mortgage rates climb from 2024 lows

Long-term rates, not fully controlled by the Fed, have been increasing as economic data indicates a slowdown in fighting inflation. Rates on 30-year fixed-rate conforming mortgages rose above 7 percent this month for the first time since May 2024.

Optimal Blue data showed rates on these mortgages averaging 7.05 percent in December, reflecting a trend towards higher rates eligible for purchase by Fannie Mae and Freddie Mac.

Progress in fighting inflation stalls

The Consumer Price Index has been climbing for three months, reaching 2.89 percent in December. Market analysts expect the economy to continue decelerating in 2025, with mortgage rates gradually declining towards 6 percent.

Samuel Tombs

Analysts anticipate a modest increase in core goods inflation following the report, with the Fed’s preferred inflation gauge close to the 2 percent target and well below the post-pandemic high in June 2022. The PCE price index data for December is scheduled to be released on Jan. 31.

Mortgage rate increases have led potential sellers to hesitate in the market, causing a “lock-in effect” that has kept home prices high. National home price appreciation is expected to slow down in the coming year.

Despite a seasonal dip, mortgage demand has shown resilience reflecting an increasing demand for refinance opportunities driven by rate adjustments. Government and non-conforming loans are increasingly being relied upon to finance in the current market.

December mortgage demand up from a year ago

Source: Optimal Blue Market Advantage report, December 2024.

Brennan O’Connell

The Mortgage Bankers Association reported a rise in applications for purchase loans last week, while cautioning against overinterpreting the data due to volatility in application volumes. Rising mortgage rates have been attributed to concerns over inflation and budget deficits.

Stay updated with Inman’s Mortgage Brief Newsletter, a weekly roundup of news in the world of mortgages and closings. Click here to subscribe.

Contact Matt Carter via email