Common Securitization Solutions (CSS) has rebranded as U.S. Fin Tech and will look to provide technology and business solutions to companies in addition to its owners.

Real estate is changing fast, and so must you. Inman Connect San Diego is where you turn uncertainty into strategy — with real talk, real tools and the connections that matter. If you’re serious about staying ahead of the game, this is where you need to be. Register now!

A little-known joint venture of Fannie Mae and Freddie Mac that processes billions in mortgage-backed securities is getting a new name and an expanded mission — offering its services to other clients.

Common Securitization Solutions (CSS) is rebranding as U.S. Fin Tech and will look to provide technology and business solutions to companies in addition to its owners.

TAKE THE INMAN INTEL SURVEY FOR JUNE

U.S. Financial Technology LLC, as CSS is now formally known, is a Delaware company co-owned by Fannie Mae and Freddie Mac and regulated by the U.S. Federal Housing Finance Agency (FHFA).

Tony Renzi

“We are excited to have a name that demonstrates that we are leading the United States and the world in financial services technology,” CEO Tony Renzi said in a statement Thursday. Renzi was appointed as CEO of CSS in 2019 and continues to lead the rebranded company.

Established as a joint venture of Fannie and Freddie in 2014, CSS operates the Common Securitization Platform (CSP), a conduit through which the mortgage giants issue and administer trillions of dollars in mortgage-backed securities (MBS) that launched in 2019.

CSS has been a fully virtual, geographically dispersed company since 2020, and boasts that its cloud-based platform provides “unrivaled layered security architecture and traceability capabilities,” ensuring “business continuity with full disaster recovery and zero data loss within 4 hours.”

CSS “meets the challenges of the market, such as data management, processing, and speed of execution, to bridge the gap between the secondary mortgage market and investors,” the company states.

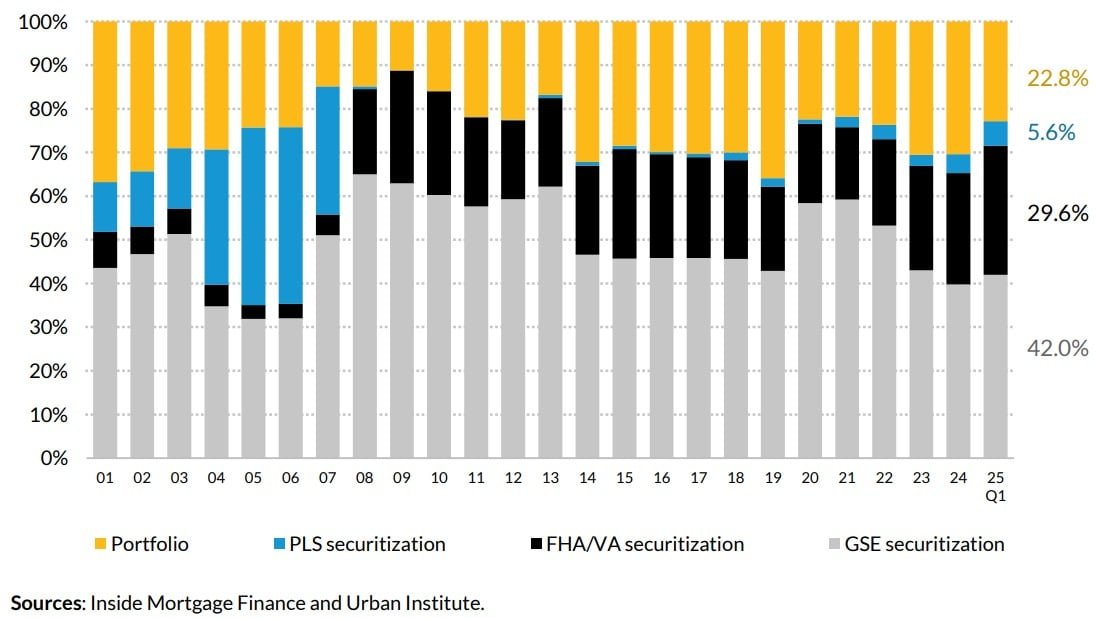

Mortgage funding sources, 2001-2025

Of the $355 billion in mortgages originated in the first quarter of 2025, Fannie and Freddie (the government-sponsored enterprises, or GSEs) packaged 42 percent into MBS for sale to investors, according to data compiled.

Close to 30 percent of Q1 2025 originations were FHA and VA loan securitizations backed by Ginnie Mae, while 23 percent were made by lenders who kept them in their portfolios.

Securitizations of private-label securities (PLS) lacking the backing of Fannie Mae, Freddie Mac, and Ginnie Mae were up 24 percent from a year ago, to $20 billion, but accounted for just under 6 percent of first-lien mortgage originations in Q1 2025.

PLS securitizations boomed at the turn of the century when lenders used them to finance subprime mortgages, but diminished for close to a decade after the 2007-2009 housing crash and Great Recession.

Fannie and Freddie were placed in government conservatorship in 2008 as their losses mounted, and potential restructuring is being studied.

Bill Pulte

Bill Pulte, selected to head the regulator for Fannie and Freddie, states that there is an interest in taking the companies public, possibly “selling a small piece” in the process.

“We created U.S. Fin Tech to showcase the remarkable innovation of American technology,” Pulte said in a statement.

Pulte has also directed the mortgage giants to consider allowing borrowers to count cryptocurrency as an asset without needing to convert their holdings into dollars.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter