Groww, India’s largest retail stockbroker, is gearing up to go public with an IPO within the next 10 to 12 months, aiming for a valuation between $6 billion and $8 billion, according to sources familiar with the matter as reported by TechCrunch.

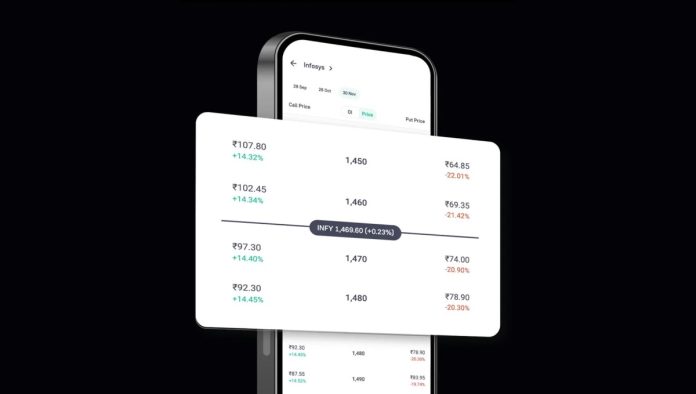

Based in Bengaluru, this listing would mark the first IPO by a digital trading platform in India, with a targeted valuation more than double its last funding round value of $3 billion in October 2021.

Backed by Peak XV, Tiger Global, and Alkeon, Groww has initiated discussions with investment banks and will soon select advisors for the IPO. The startup, which facilitates investments in mutual funds and UPI transactions, relocated its headquarters to India from the U.S. last year in preparation for the IPO.

Groww has refrained from offering comments on the matter.

Positioning itself ahead of competitors in India’s bustling retail investment landscape, Groww boasted 13.2 million active users in December, surpassing Zerodha’s 8.1 million users as per National Stock Exchange data. The platform is consistently attracting between 325,000 to 550,000 new users per month, twice the rate of its competitors according to the exchange.

India has emerged as a prominent hub for tech IPOs globally, with seven technology startups going public in 2024. Swiggy’s $1.35 billion IPO in the previous year stood as the largest tech listing worldwide.

Over 20 Indian startups, including Zetwerk, Table Space, PayU, and PharmEasy, are planning IPOs in 2025.

JPMorgan’s head of equity capital markets for India, Abhinav Bharti, highlighted India’s growing domestic capital and policy stability as contributing factors to the surge in IPO activities in the country during a recent interview with TechCrunch.

The market capitalization of listed companies in India doubled to $5.3 trillion in 2014 from 2019, while daily trading volume tripled to $15 billion.

Bharti emphasized the political certainty and policy consistency in India, stating, “No other country globally provides you with this much political certainty and continuity of policy. You can argue against a policy decision, but you cannot argue against the fact that they have been consistent.”