- Amid the stock market volatility following President Donald Trump’s “Liberation Day” tariffs, consumer spending has shown resilience, with credit card companies offering positive outlooks during quarterly earnings calls. However, measures are being taken to manage potential losses in case of an economic downturn.

President Donald Trump’s trade policies have unsettled the stock market, but the impact of his “Liberation Day” tariffs on consumer spending is not yet reflected in the financial reports of major lenders, which typically provide early insights into consumer behavior.

Credit card companies reported strong earnings as consumers continued to borrow, spend, and open credit cards at a higher rate compared to the previous year.

During Citigroup’s quarterly earnings call, the company’s chief financial officer Mark Mason highlighted the resilience and cautious spending behavior of consumers amid a shift towards essential purchases over travel and entertainment.

JPMorgan Chase noted a 7% increase in credit and debit card spending year-over-year, along with an uptick in credit card balances. Bank of America reported a 4% rise in credit and debit card spending compared to the previous year, accompanied by a decrease in late payments from borrowers.

Despite the positive trends, credit card companies are bracing for a potential economic downturn as delinquencies have reached a five-year high.

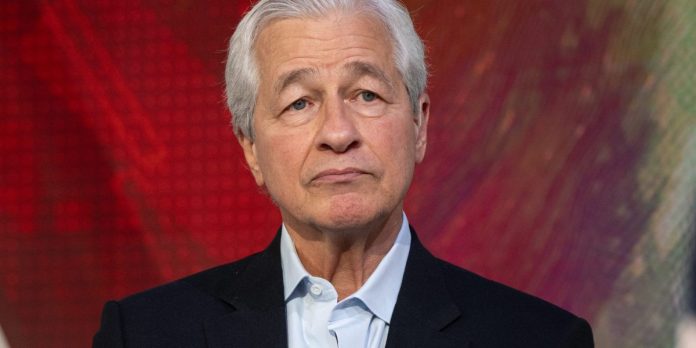

During JPMorgan Chase’s recent earnings call, the finance chief Jeremy Barnum expressed uncertainty about the future economic landscape and announced an increase in reserves to cover potential losses.

JPMorgan anticipates a 60% risk of recession and has bolstered its reserves to $27.6 billion to address credit losses, in addition to increasing its loan loss provisions by 73% compared to the previous year.

Citigroup is also taking precautions by raising its cost of credit by more than 15% and boosting total reserves by $1 billion in the first quarter to $22.8 billion, in preparation for a potential economic downturn.

Citigroup maintains a strong liquidity and capital position, with cash levels at $960 billion.

This story was originally featured on Fortune.com