After posting $33 million in profit in 2024, a mortgage company’s parent organization announced on Thursday its plans to invest further in loan servicing and originations technology to enhance customer service.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

A loan servicer and reverse mortgage lender recently restructured its debt and reported its most profitable year in over a decade, stating its commitment to investing in technology.

The company, now known as Onity Group Inc. after rebranding in June 2024, mentioned that despite a $29 million fourth quarter loss due to debt restructuring charges, it ended the year with a $33 million net profit, marking its most profitable year since 2013.

Onity’s CEO Glen Messina highlighted the company’s achievements in reducing debt, improving digital capabilities, and extending maturities, leading to a growth in book value per share.

Shares in Onity experienced an 8% decline on Thursday, closing at $35.99.

Growing servicing portfolio

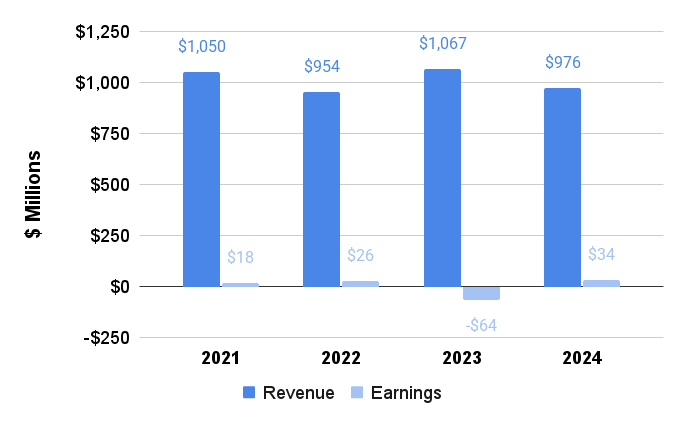

Source: Onity Group regulatory filings and investor presentations.

PHH Mortgage, a subsidiary of Onity, is a major mortgage loan servicer in the U.S., managing monthly payments and borrower concerns for over 1.4 million borrowers with a total mortgage debt exceeding $300 billion.

Aside from servicing loans, PHH Mortgage also engages in mortgage originations, witnessing a 33% growth in 2024, with a significant portion of this business generated in the fourth quarter.

The company’s investment in AI and other technologies during this period resulted in significant time savings and increased customer satisfaction.

Onity’s workforce is predominantly located outside the U.S., with a large number of employees based in India and the Philippines.

Onity back in the black

Source: Onity Group regulatory filings.

After a net loss in 2023, Onity rebounded in 2024 by entering into agreements to restructure its debt and capital. These strategic moves are expected to improve the company’s financial position and provide opportunities for future growth.

Furthermore, a sale of assets and the issuance of new notes have bolstered Onity’s financial structure, enabling it to pursue growth initiatives and enhance shareholder value.

Onity’s commitment to debt restructuring and strategic partnerships reflects its dedication to continued success and growth in the mortgage servicing industry.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter