The research study involved four major activities in estimating the size of the entertainment content and goods market. Exhaustive secondary research has been done to collect key information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. The market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect the information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology-oriented perspectives.

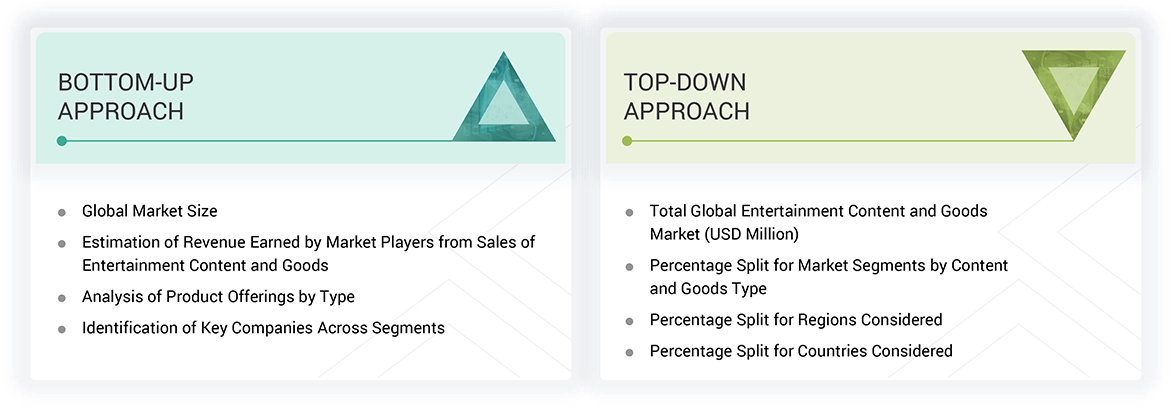

The entertainment content and goods market report estimates the global market size using top-down and bottom-up approaches and several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

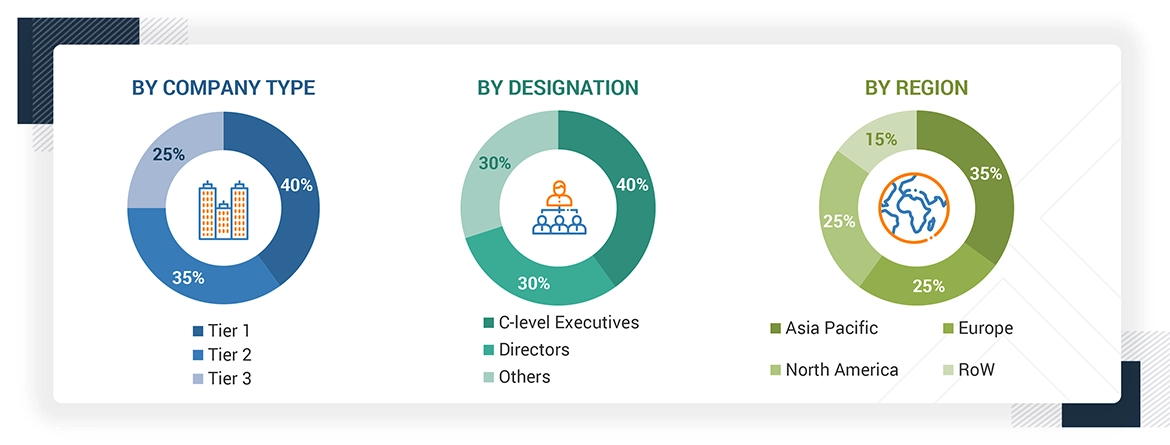

Extensive primary research has been conducted after understanding the entertainment content and goods market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews. Questionnaires and emails have also been used to collect data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the entertainment content and goods market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Estimating the market size of each key segment within the entertainment content and goods market, namely:

- Music artist goods (merchandise, collectibles, concert-linked items)

- Licensed goods (sporting equipment – licensed) (officially branded merchandise linked to major sports leagues and athletes)

- Animated content creation (film/OTT) (production and distribution of animated content via streaming platforms, cinema releases, and merchandise)

- Breaking down each segment by region—North America, Europe, Asia Pacific, and RoW—followed by detailed country-level estimation based on demand trends, consumption patterns, content popularity, and merchandise penetration rates

- Analyzing region- and country-level consumer behavior, fanbase size, IP monetization strategies, and cultural consumption preferences to derive segment-specific country revenues

- Aggregating the revenues of all segments at the country level to derive total market size by country, followed by aggregation of country-level data to estimate regional market sizes, and finally summing regional values to determine the global market size

- Validating segment-wise assumptions by triangulating with content consumption metrics, digital platform usage, IP franchise growth, and merchandising expansions from public sources, annual reports, streaming trends, and media publications, and finally aligning insights with the domain experts at MarketsandMarkets to ensure robustness and precision in market projections

Entertainment Content and Goods Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the entertainment content and goods market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply perspectives. Along with data triangulation and market breakdown, the market has been validated through the top-down and bottom-up approaches.

Market Definition

The Entertainment Content and Goods Market encompasses creating, commercializing, and consuming digital media content and associated branded merchandise derived from intellectual property (IP), artist influence, or licensed franchises. This market captures the intersection of cultural expression, consumer fandom, and monetization strategies across music, sports, animation, and other entertainment domains.

At its core, the market comprises two primary pillars: content creation and goods commercialization. Content creation includes digital formats such as films, TV/OTT series, and animated productions in 2D, 3D, stop-motion, and mixed media styles. These are increasingly delivered through global streaming platforms, forming the narrative foundation for merchandise, fandom, and brand engagement.

Complementing the content layer is a vast and diverse merchandise segment that includes music artist goods, such as printed apparel, accessories, lifestyle items, signed memorabilia, and branded instruments. Similarly, licensed goods related to sports teams, celebrities, esports, and entertainment franchises drive global demand for apparel, collectibles, sporting equipment, and lifestyle accessories. These goods are distributed through online artist stores, tour/event merchandising, e-commerce platforms, and retail partnerships.

The market is driven by rising consumer affinity for pop culture, the growing influence of artist-led branding, and the expanding global reach of content IPs. Fan-based consumption behavior and digital platforms enabling global access to content and merchandise continue to reshape how entertainment is monetized. As such, the market represents a dynamic convergence of media, commerce, and consumer identity.

Key Stakeholders

- IP Creators and Rights Holders

- Branded Merchandise Manufacturers and OEMs

- Licensing and Brand Collaboration Agencies

- Direct-to-Fan and E-commerce Platforms

- Retail Chains, Fashion Collaborators, and Pop-up Stores

- Streaming Platforms and Digital Content Distributors

- Digital Rights Management (DRM) and IP Protection Firms

- Fan Engagement, Loyalty, and Community Management Platforms

- Influencer Marketing and Talent Management Agencies

- Advertising, Branding, and Promotional Service Providers

- Regulatory Authorities and IP Protection Agencies

- Industry Associations and Entertainment Trade Forums

- Research Institutes and Academic Bodies

- Content Consumers, Fans, and Patronage Communities

Report Objectives

- To describe, segment, and forecast the size of the entertainment content and goods market, by music artist goods type, licensed goods type, and animated content creation, in terms of value

- To forecast the size of various segments for four regions: North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To offer detailed information on drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the entertainment content and goods market value chain analysis, pricing analysis, ecosystem analysis, technology analysis, case study analysis, trends/disruptions impacting customer business, and key conferences and events

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To benchmark the key players and analyze their market position in terms of revenue, market share, and core competencies, and a detailed competitive landscape for the market leaders

- To analyze competitive developments, such as product/services launches, expansions, acquisitions, partnerships, collaborations, and agreements, carried out by players in the entertainment content and goods market

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World