Mike DelPrete analyzes the near-monopoly that the most prominent portals have in their markets and how that translates into pricing power.

This article was shared here with permission from Mike DelPrete for Inman Intel, a data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

Real estate portals occupy strong market positions globally, giving them incredible pricing power.

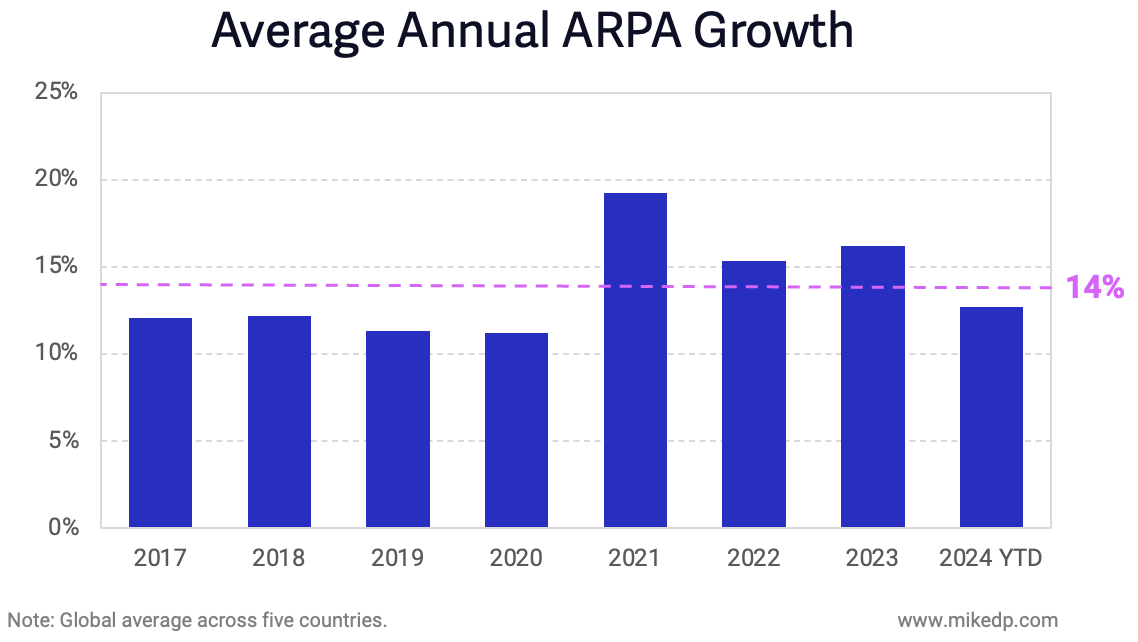

Why it matters: That power equates to ever-increasing prices — as measured by Average Revenue per Advertiser (ARPA) — and is the engine for portal revenue growth around the world.

- ARPA growth is a combination of base price increases and additional, value-add products, such as premium listings with greater exposure.

- For the leading portals across five global markets — Australia, Germany, Sweden, the U.K. and the U.S. — ARPA growth has increased an average of 14 percent each year.

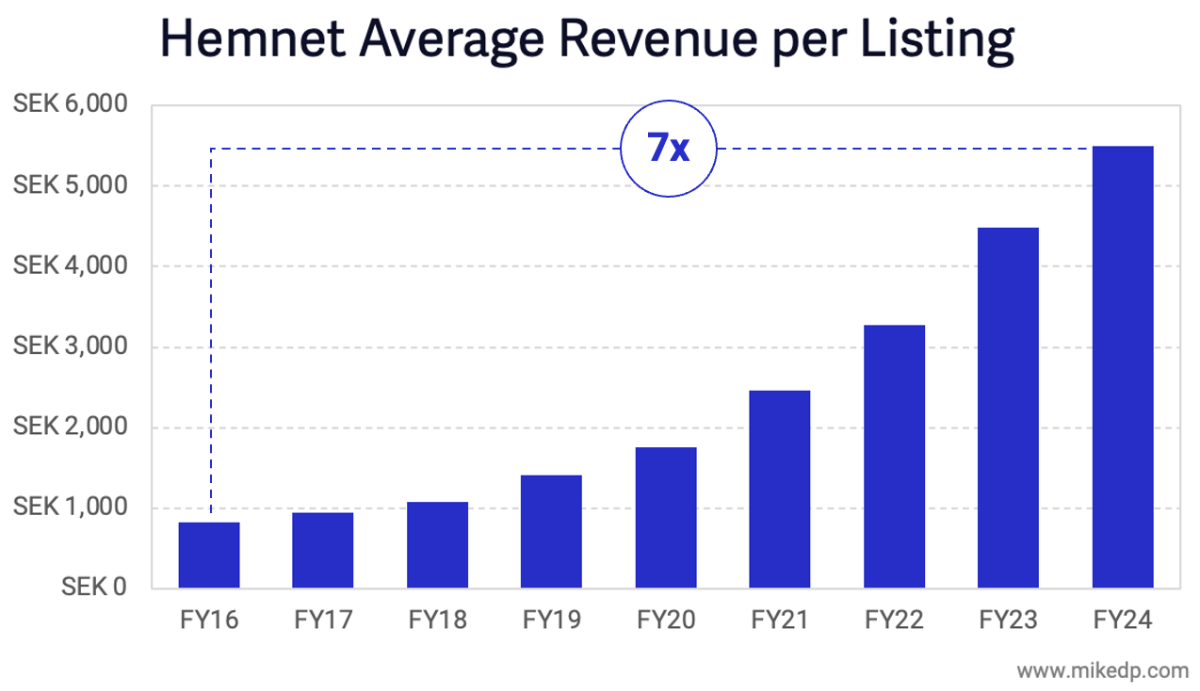

A deeper dive highlights the rich potential of vendor-funded markets (where the homeowner pays their online marketing costs).

- Australia and Sweden are two vendor-funded markets (there are only a handful in the world), with the local portals converging on 20 percent ARPA growth — compared to about 10 percent in the other markets.

Sweden’s Hemnet is the clear standout, having grown its ARPA a massive 7X since being acquired by private equity firm General Atlantic in 2016.

- That’s a beautiful-looking graph for investors; homeowners may disagree.

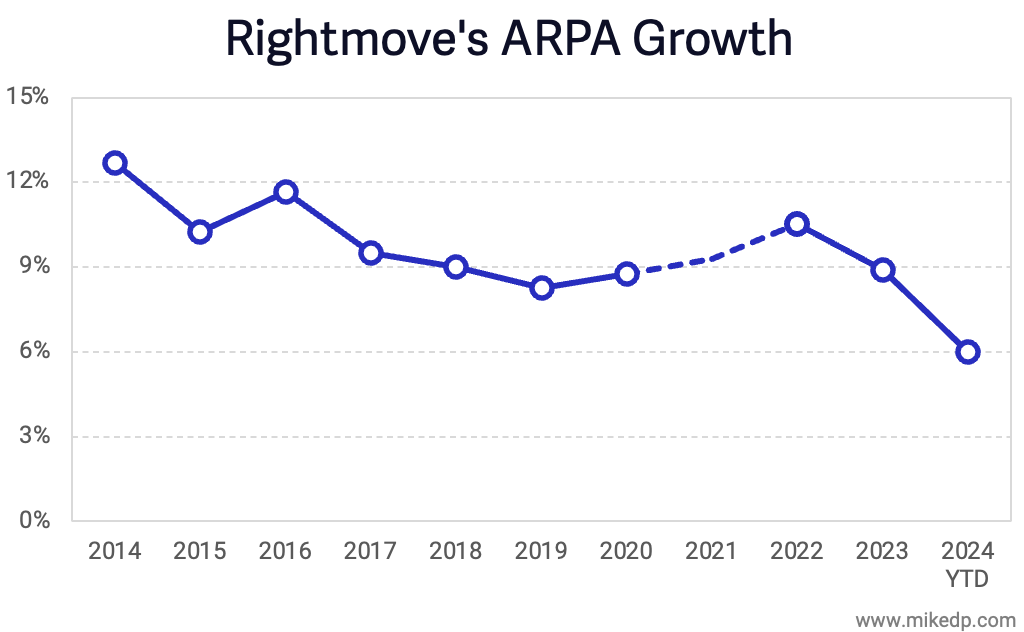

The U.K.’s Rightmove may be the most consistent operator in the space with steady annual ARPA increases of about nine percent.

The U.K.’s Rightmove may be the most consistent operator in the space with steady annual ARPA increases of about nine percent.

- However, the portal is facing headwinds in 2024 with a lower rate of growth.

- The U.K. market has loudly complained about Rightmove’s prices for years, but a look at its global peers suggests that it could be worse.

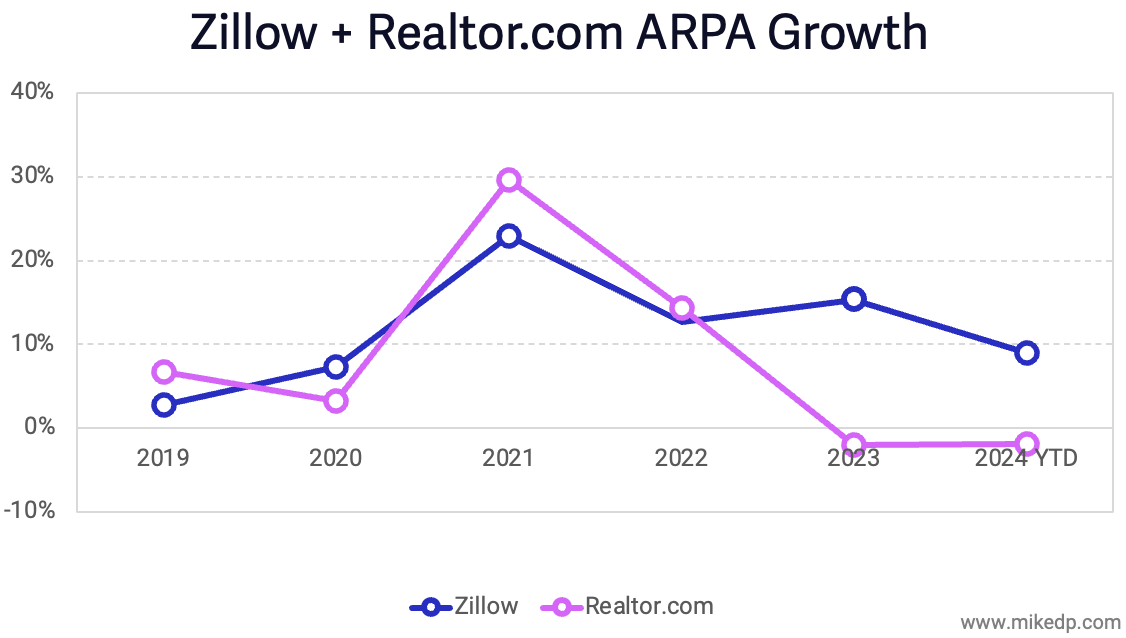

In the U.S., I’ve calculated a rough approximation of ARPA based on a portal’s real estate lead gen revenue divided by the total number of transactions in the market.

In the U.S., I’ve calculated a rough approximation of ARPA based on a portal’s real estate lead gen revenue divided by the total number of transactions in the market.

- Both Zillow and realtor.com rode the pandemic wave with record revenues, and since then Zillow has maintained its robust pricing power.

The bottom line: As outlined in the Real Estate Portal Strategy Handbook, 93 percent of portal revenue growth has come from core listings and lead gen products – most of that from ARPA increases.

- Leading real estate portals are near-monopolies in their markets, offering consumers unparalleled and unrivaled exposure and reach.

- This powerful proposition translates to pricing power, and over time, those prices only move in one direction: up.

Mike DelPrete is a strategic advisor and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.