Lifestyle hotels are transforming hospitality by emphasising vibrant public spaces over traditional rooms, where travellers and locals connect through distinctive experiences. JLL’s latest report highlights that this sector is offering opportunities for brands and investors, as highlighted with the recent acquisitions of Standard International by Hyatt and of CitizenM by Marriott International.

2008 sparked Asia Pacific’s lifestyle hotel boom

In 2008 alone, brands like W Hotels and Aloft inaugurated and expanded their first properties in the region, establishing the foundation for what has evolved into a major hospitality industry movement.

How will the lifestyle hotel revolution shape hospitality in the region in the years to come?

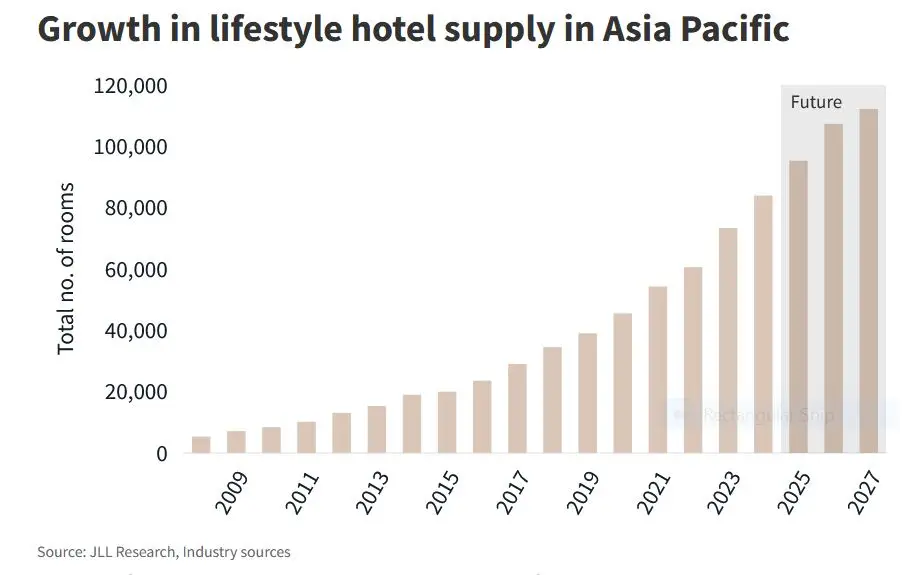

1. Four times more lifestyle hotel rooms in 2024 than in 2014, with lifestyle supply anticipated to grow by 34% by 2027

Since 2014, nearly 65,000 new lifestyle hotel rooms have been introduced to the Asia Pacific market and have now quadrupled in number. This strong growth rate reflects both shifting consumer preferences toward experiential stays and strategic repositioning by hospitality groups and independent operators.

In 2024, lifestyle properties achieved their highest representation among all new hotel openings. The momentum shows no signs of slowing, with lifestyle hotels likely to constitute between 6-9% of all new hotel supply entering the market between 2025 and 2027. This surpasses even the record-breaking levels observed in 2024.

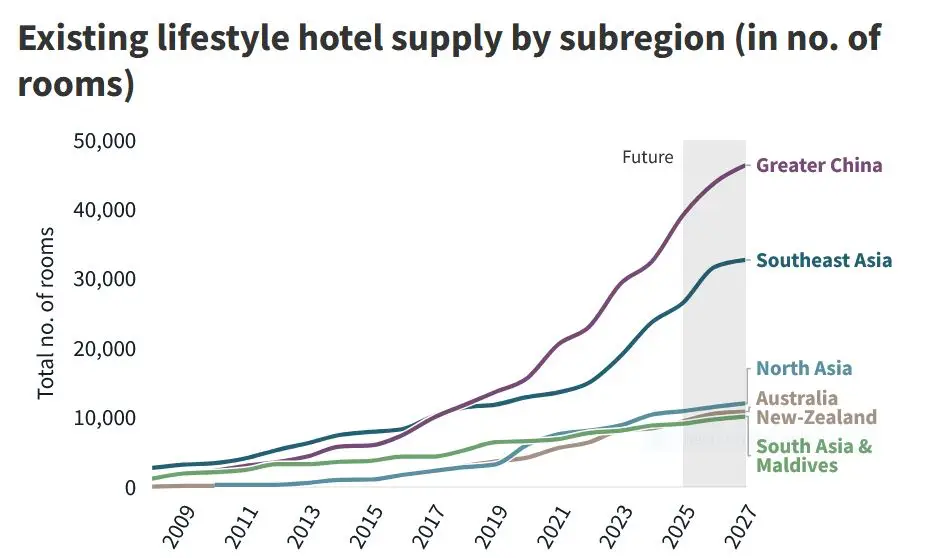

2. Southeast Asia counts three times more lifestyle hotel rooms than Australia New-Zealand and South Asia, yet ‘Down Under’ displaying the strongest growth

Lifestyle accommodations experienced growth across all subregions over the past ten years.

Despite Greater China outpacing the rest of the region in total number of lifestyle hotel rooms with the proliferation of prominent brands like Indigo, W and aloft, Southeast Asia was the first subregion where lifestyle hotels took off.

Indeed, Southeast Asia saw rapid development in lifestyle hotel offerings, propelled by the introduction and growth of brands such as Aloft, Autograph Collection and Hotel Indigo.

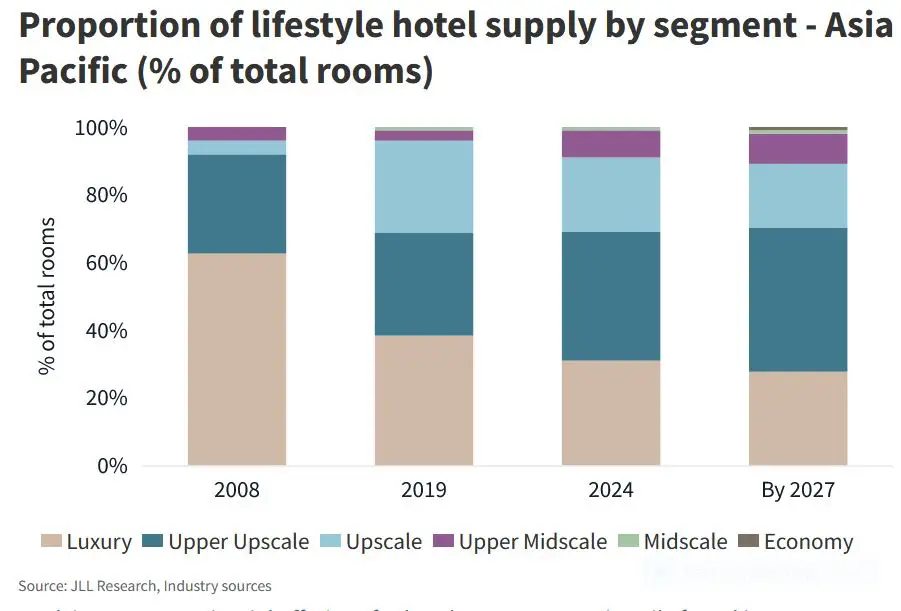

3. Lifestyle hotels concentrated in upscale and above segments, yet upper midscale and below show promising growth

Back in 2008, 62% of lifestyle hotel inventory that year was concentrated in the luxury as the first mover segment in lifestyle. This trend has persisted following the pandemic, with lifestyle brand growth continuing to occur predominantly in the luxury and upper upscale segments.

New luxury lifestyle brands entering the APAC market between 2025 and 2027 include: Emblems, The Unbound Collection, Thompson Hotels and Delano. Gradually, lifestyle is taking a firmer hold in the higher volume segments and domestic-focused products in the three-star and entry level four-star categories in Asia Pacific.

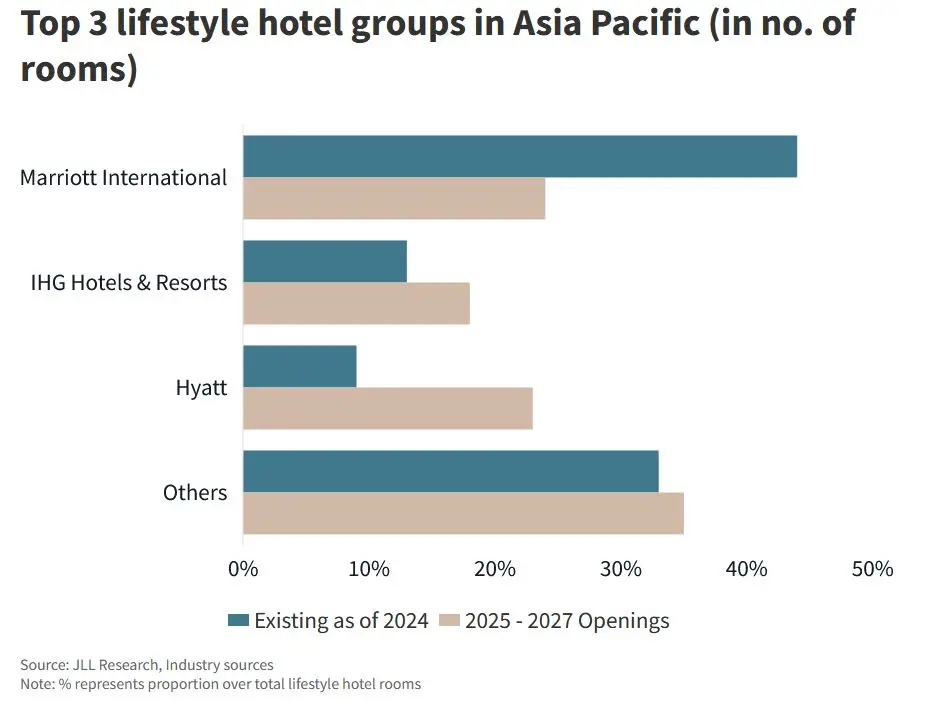

4. Ten new lifestyle brands anticipated to enter Asia Pacific by 2027

Marriott International leads the Asia Pacific region with 11 lifestyle brands, representing 44% of the total existing lifestyle hotel supply as of 2024. IHG Hotels & Resorts follows in second place with four brands, while Hyatt occupies the third position.

Looking ahead to 2027, Marriott International maintains its market leadership, whilst lifestyle hotels under Hyatt brands are anticipated to represent 23% of the total upcoming new lifestyle supply between 2025 and 2027.

Lifestyle brands are anticipated to continue expanding in Asia to support interest from both investors and guests, especially for brands that have been recently acquired by international hotel chains, such as NoMad (Hilton), CitizenM (Marriott), The Standard (Hyatt), Ruby (IHG), and European/US based lifestyle hotel chains.

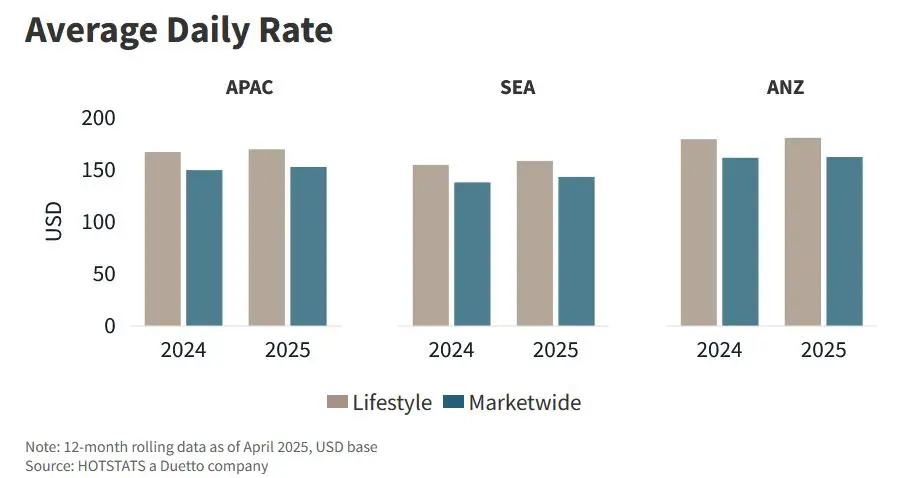

5. Lifestyle hotels in APAC command a 10-11% price premium, however with nuances

In Asia Pacific (APAC), lifestyle hotels command a price premium of an Average Daily Rate (ADR) of approximately 10-11% above the overall market average. This indicates sustained consumer willingness to pay higher rates for lifestyle hotel experiences through market cycles.

Where this price premium is paired with smaller room sizes, returns to investors are further elevated. Beyond this, investment returns can be enhanced through more appealing wellness and dining outlets, as well as associated branded residences or being integration in mixed-use precincts.

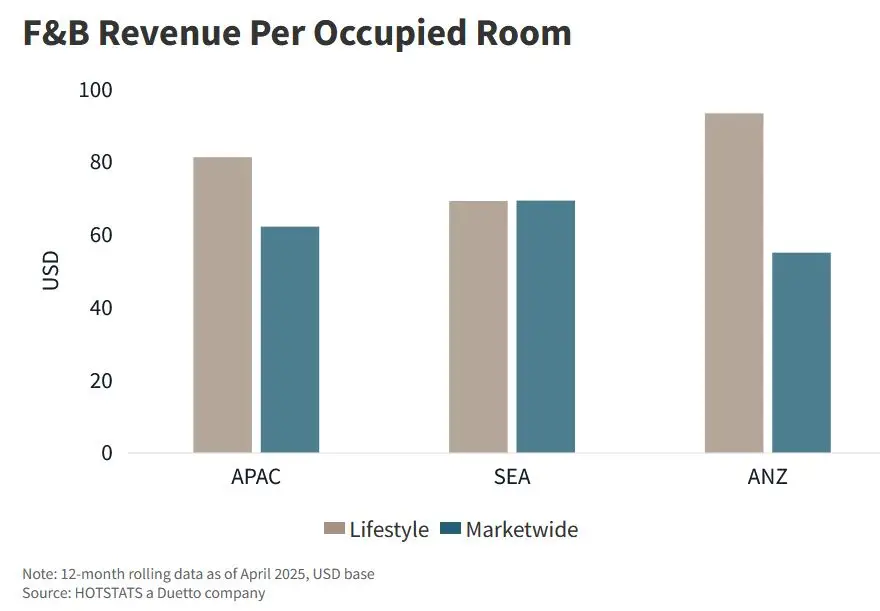

6. Lifestyle hotels registering 30% higher F&B (including MICE) revenue per occupied room on average compared to traditional hotels

In Asia Pacific, lifestyle hotels see their Food & Beverage (including MICE) recorded approximately 30% higher revenue per occupied room than the broader market average.

Globally lifestyle hotels tend to over-index on dining outlets and bars as part of delivering a more engaging and enhanced stay. This generally holds true in Asia, although the revenue premium may be less pronounced as many hotels (especially in Southeast Asia) have extensive F&B outlets across the board.

Conclusion

Lifestyle hotels in Asia Pacific have quickly moved from being an emerging segment to core to every urban and resort market in the region with depth – attracting many savvy investors. The addition of a further 34% growth in lifestyle supply by 2027 signals a continued upward trend in the segment.

Southeast Asia’s leading position, complemented by brand proliferation in Australia, will reshape competitive dynamics across the region. As the sector continues to evolve, the question remains whether pricing premiums will hold – all indications are that it will for now.

Lifestyle hotels concepts, brands and design will continue to flourish, emphasising authenticity, sustainability, and ultra-personalisation — establishing this segment as a fundamental and expanding component of Asia Pacific’s hospitality landscape.