A new proposal suggesting a tax on the unrealised gains of wealthy individuals has sparked outrage among Silicon Valley’s wealthiest investors.

Last week, US vice-president Kamala Harris, the Democratic nominee for the 2024 presidential election, unveiled a tax plan aimed at generating nearly $5tn over the next decade. This plan includes the contentious tax proposal, which is also part of President Joe Biden’s federal budget plan for 2025.

Under this plan, individuals with more than $100mn in wealth would be required to pay a minimum of 25% in taxes on both their income and their unrealised capital gains, which represent the value of the appreciation in their assets like stocks, bonds, real estate, and other investments such as stakes in start-up companies.

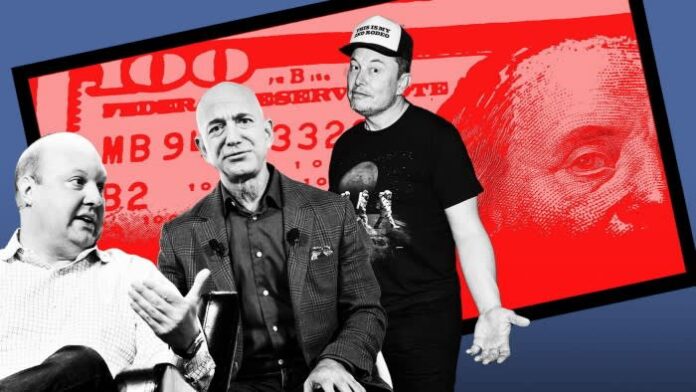

Although it is a challenging political endeavor, if implemented, it would revolutionize how America’s wealthiest are taxed by including investment gains before assets are sold or the individual passes away. The likes of Elon Musk, Warren Buffett, Jeff Bezos, and other billionaires whose wealth is primarily from their stock holdings, as well as founders and supporters of successful start-up companies, could potentially face significant tax bills.

“It affects a small number of people, but for those impacted, the impact is substantial,” said Michael Bolotin, a tax partner at Debevoise & Plimpton law firm.

Despite some pushback from technology investors who argue that the tax could hinder innovation by penalizing the growth of high-performing start-ups, supporters of the proposal believe that the benefits of increasing taxes on the ultra-wealthy outweigh the downsides.

This proposal has also caused friction with affluent donors who have backed Harris, leading to private discussions urging her to remove the proposals from her campaign platform.