Inman’s tech expert Craig Rowe reviews Foyer, an app built around FHSAs — First Time Homebuyer Savings Accounts. The interest-bearing account type is designed for exactly what it sounds like, and in 12 states, it offers tax advantages.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain powerful insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

Foyer is a fintech app for first-time homebuyers.

Platforms: Web; iOS; Android

Ideal for: First-time buyers and their agents

Top selling points:

- Facilitates First Time Homebuyer Savings Accounts

- 6 percent down payment match

- Home buying journey tracker

- 10x national average savings interest

- FDIC insured

Top concerns:

First-time homebuyers are tough for agents to crack in the current market, so industry adoption could be an uphill battle. However, this is why the company has been targeting consumers directly.

What you should know

Assuming it’s not based on an overly aggressive fee model or built by a team of arrogant tech-shits aiming to “disrupt homebuying,” I’m generally down with any solution that altruistically aims to help aspiring homebuyers better understand what it takes to buy and own a home.

Apps in this ilk, like Foyer, help agents bear the burden of educating the new buyer as to what it takes to buy, an issue made all the more tough to surmount because of the prevailing sentiment that everyone needs 20 percent down to even start the engine. I’ll add that agents who won’t talk to a buyer who hasn’t yet prequalified are only picking at that scab. Don’t ignore them — help them. (You know who you are.)

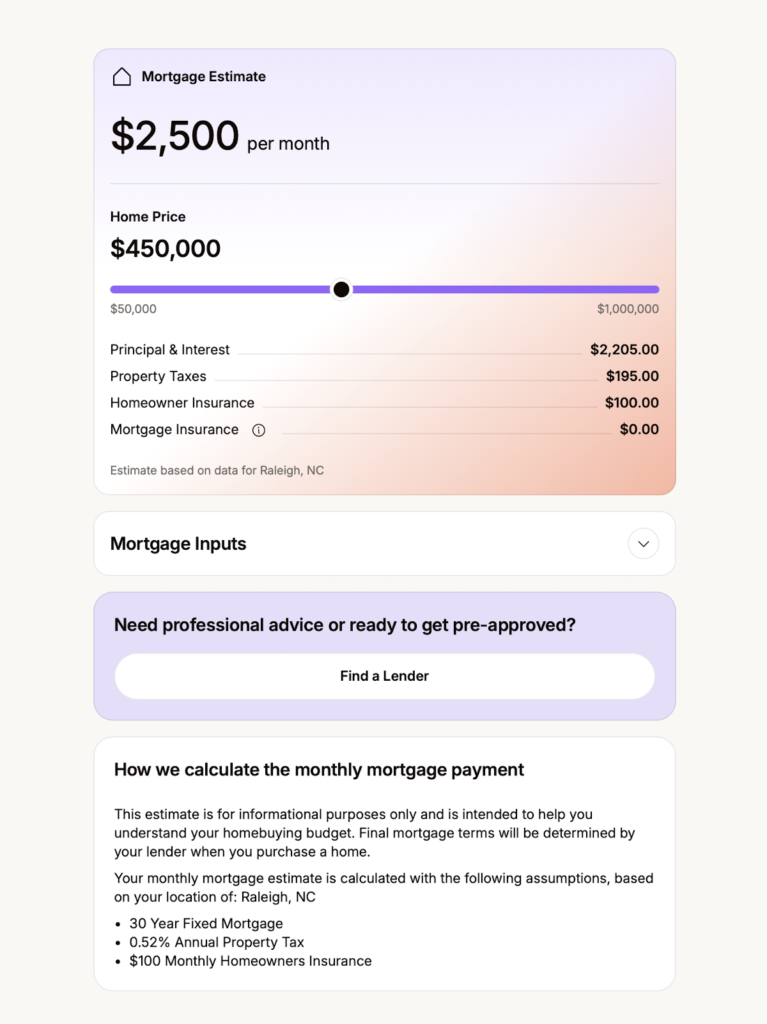

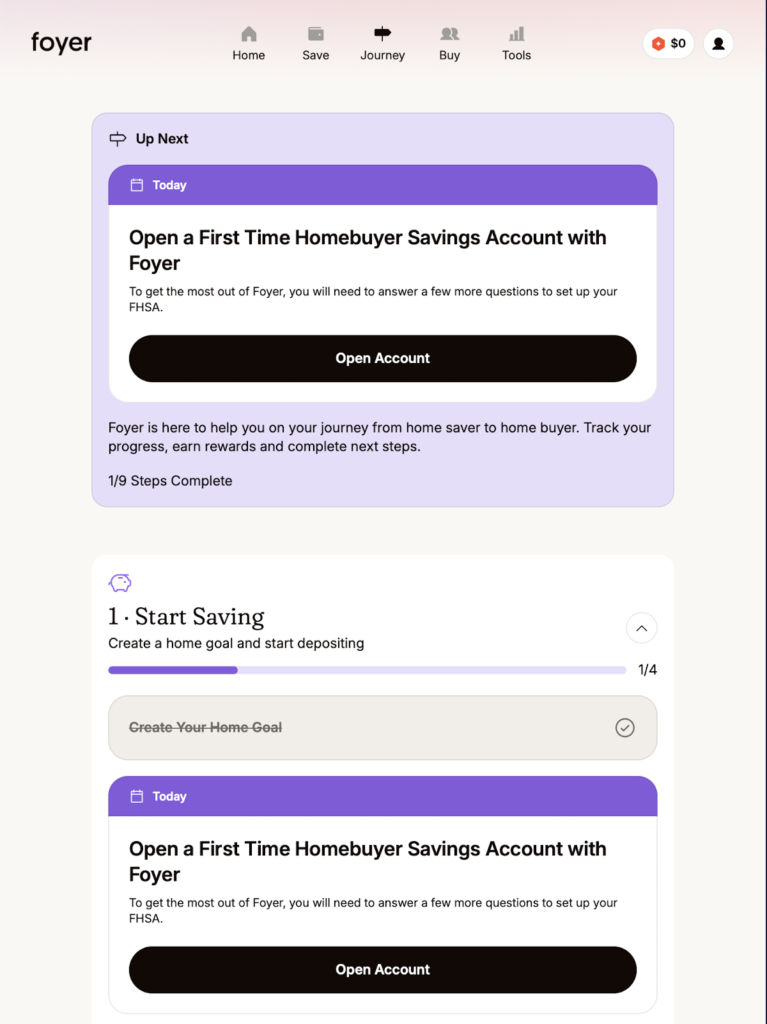

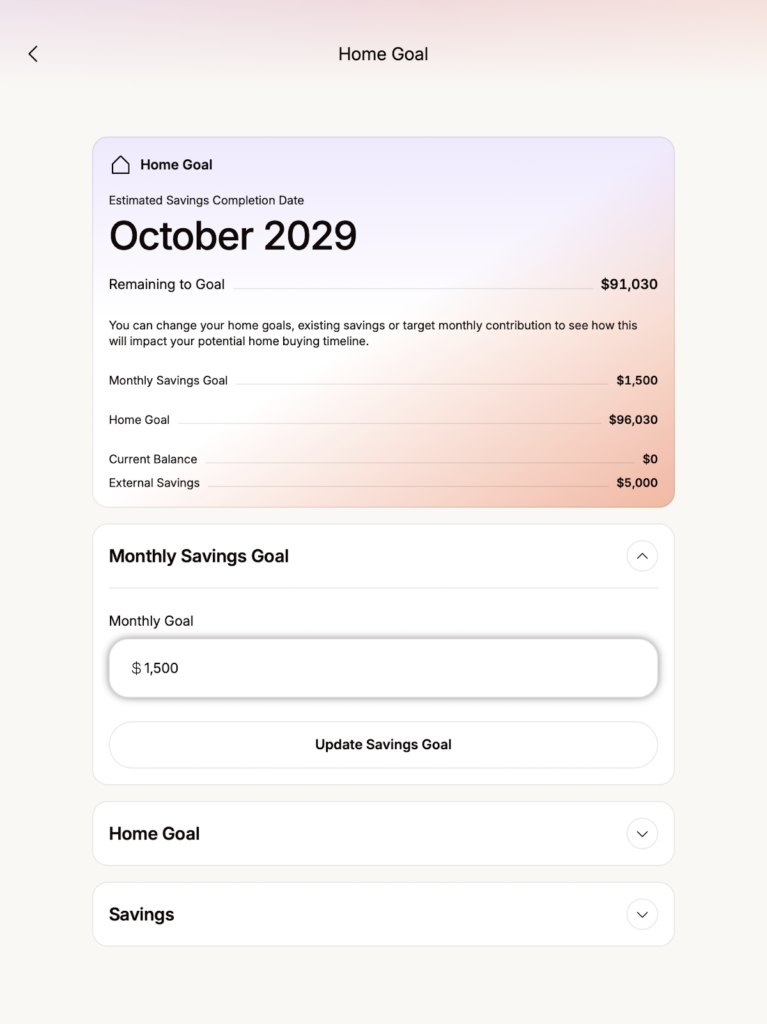

Foyer is a banking app focused on the first-time homebuyer. It comes standard with a simple Plaid integration for the user to move funds into an FDIC-insured account that launches a series of features for the user to track money, manage timelines, monthly and overall financial goals, understand state-by-state closing costs and estimate mortgage payments, among other features.

The company offers and built its features around FHSAs — First Time Homebuyer Savings Accounts. The interest-bearing account type is designed for exactly what it sounds like, and in 12 states it offers tax advantages. (They can be opened in any state.) If you’re an agent in one of those places and haven’t added FHSAs to your marketing and new buyer pitches, well, that’s why Foyer was created.

Foyer has a nice explainer on FHSAs here, but it won’t hurt to also chat with your mortgage and banking partners to gain additional perspective.

The company enhances benefits with its savings match, the amount of which is based on the user’s account level, either 2 percent or 5 percent at the Pro level. It’s easy to set recurring deposits or move money as needed, and each deposit is applied to the goal-tracking functions and homebuying budget.

Consumer-driven with a lightweight, visually ergonomic UX and fast, secure onboarding, the app also offers the opportunity for consumers to become pre-qualified through mortgage partners and, yes, helps find an agent.

Still less than 2 years old (it landed $6.2 million in Seed funding in January), the company is only now stepping into its agent-partnership features. It’s location-based and should be considered a reliable resource for eager leads who are taking action to buy. The company collects a fee at closing, a common structure for lead referral models.

The app should be considered a supplement to other lead-generation tactics and a resource to send to those just entering the market. I’d argue its leads, once captured, would be better than most sources you’re currently paying.

If it were me, I’d contact Foyer and co-market a new buyer seminar or ask them to contribute to the number of content resources they provide on the app that help explain the process.

Although there are other apps out designed to help people save, Foyer is the first to demonstrate to me a more tech-savvy method to open and control FHSAs. I’m wondering how many readers have heard of them and, if so, considered their benefits. These are the type of apps I most enjoy sharing in this space — not fintechs or savings tools specifically, but those that create a better consumer experience around a vague but valuable tool for homebuyers.

Innovation isn’t defined by an entirely new idea; it’s best when it makes an existing one better.

Have a technology product you would like to discuss? Email Craig Rowe

Craig C. Rowe started in commercial real estate at the dawn of the dot-com boom, helping an array of commercial real estate companies fortify their online presence and analyze internal software decisions. He now helps agents with technology decisions and marketing through reviewing software and tech for Inman.