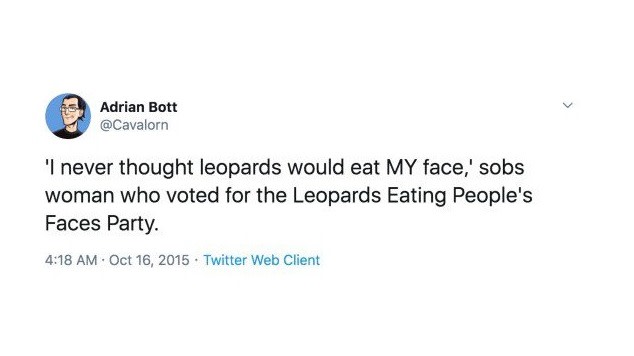

It has been widely observed that markets had high hopes that Donald Trump would prioritize actions that benefitted markets while avoiding actions that could harm them. However, recent events have shown a different reality.

Wall Street analysts have had to quickly adjust their views to reflect this new reality. Standard Chartered’s pre-written Sunday Macro Strategy note mentioned that concerns over tariffs had eased slightly as Trump focused more on domestic issues in his initial weeks in office.

Other optimistic analysts also had their hopes dashed as Trump followed through with his long-promised actions. The impact of these decisions is reflected in investment notes that have been circulating, with experts sharing their insights on the situation.

A sellside round-up

Deutsche Bank’s George Saravelos expressed surprise at the speed and extent of the tariffs imposed by Trump, highlighting the macroeconomic implications and the need for a significant repricing of trade war risks in the market.

Goldman Sachs, on the other hand, had to revise its forecasts in light of the new tariff details, acknowledging the potential impact on core US inflation and economic growth.

Morgan Stanley anticipates a more significant impact on growth and inflation, with a potential recession in Mexico and higher US inflation and lower growth rates expected.

Various analysts have differing views on the potential outcomes of Trump’s tariffs, with some remaining optimistic about a resolution, while others foresee more significant economic consequences.

The market’s response to these developments remains uncertain, with key indicators like the dollar, US equity futures, and cryptocurrency values showing volatility. The full extent of the market’s reaction and the Trump administration’s response will be closely monitored in the coming days.

Despite the uncertainty, some analysts believe that the tariffs may not be permanent and that market reactions could influence future decisions. However, the long-lasting impact of elevated tariff risks may affect all of America’s trading partners.

Overall, the situation has forced a reevaluation of market expectations, with some analysts warning against being complacent about the threat of tariffs and urging preparedness for potential economic shifts.

Despite differing views, the ultimate impact of Trump’s tariffs and future actions remains to be seen as markets and analysts navigate the evolving landscape.