Surag Patel started building a cybersecurity company in Baltimore in 2022. But a new tax starting today on technology services has him second-guessing the startup’s headquarters.

The founder of Pixee, Patel last May announced a $15 million investment to expand staff and open an office. He’s concerned, though, about Maryland’s new 3% “tech tax” on IT, data and software publishing services. It could take up to two months of a full-time hire’s job to figure out compliance, Patel believes, and might limit his company’s growth.

There are no specific plans or states in mind to move to as of now, per Patel. TEDCO, Maryland’s investment vehicle and investor in the startup, requires Pixee to stay in the state for a certain period of time and hire a percentage of workers within its borders.

TECH TAX FACTS

How does the tax work?

- The law outlines certain codes in the North American Industry Classification System (NAICS) to be taxed. That includes sectors 518 or 519, subsector 5415, and a system software or application software publishing services described under NAICS subsector 5132.

- The law cites the 2022 edition of the NAICS. It will continue to do so even when the NAICS gets updated in the coming years, unless legislatures change the law, per a Comptroller of Maryland official.

When does the tax apply?

- If a company in Maryland sells to a buyer in the state.

- If an out-of-state seller with a physical presence in Maryland (like an employee installing cable or running a data center in the state, for example) is selling to a Maryland buyer.

- A seller with no ties to Maryland vending to an in-state buyer must collect the tax if, during the previous or current calendar year, the gross revenue of sales exceeds $100,000 or if over 200 individual sales take place in Maryland.

- Maryland sellers vending outside of the state do not need to charge the tax.

- Remittances to the government are required. Businesses need to file a sales and use tax return and remit payment of the tax collected on or before the 20th of the month following the end of the period when the sale takes place. Depending on the sale, the state may assign either a monthly or quarterly filing frequency.

- Vendors can get credit for remitting to the state on time, per a Comptroller official — 0.9% of the gross amount of tax remitted valued up to $500 per return.

What’s exempt from this tax?

- Sales of cloud computing to cybersecurity businesses

- Certain businesses in the University of Maryland Discovery District (the Governor’s Office did not clarify why these companies are exempt)

- Governments, nonprofits and charitable organizations

- Software as a service, or SaaS, is already taxed at 6% when sold to an individual. But an enterprise system, previously not taxed, is now taxed at 3%.

What is a Multiple Points of Use Certificate?

- This certificate applies if purchased services are also used outside the state. The Comptroller official gave an example to explain: Let’s say a Maryland-headquartered company is buying software for staff across the globe. The buyer can file a certificate so the vendor doesn’t collect the tax for the IT outside of the state.

“It’s enough for us to think about,” Patel told Technical.ly. “Maybe the idea of building and doing everything in Maryland and Baltimore is not the idea.”

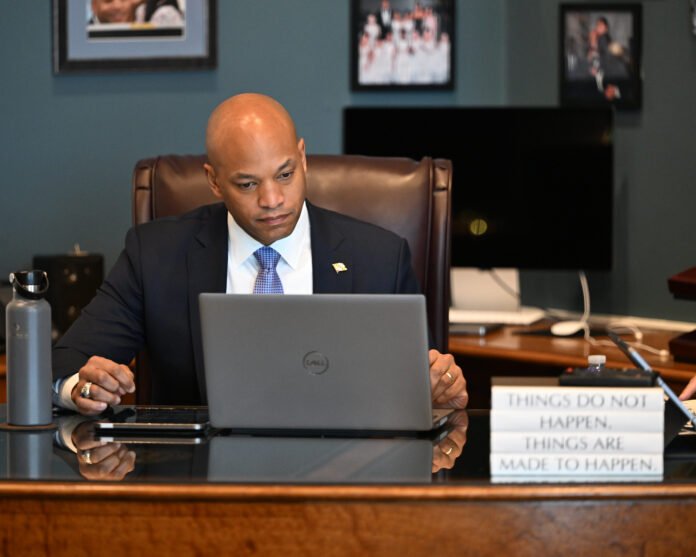

The tax on certain tech services went into effect on July 1, thanks to Gov. Wes Moore’s late May signature on the bill that accompanies the state’s main budget. The tax is projected to bring in $482 million, per a committee report.

Plans to purchase new accounting software, hire help

Patel, cofounder of Pixee, isn’t the only person scrambling to comply.

Darren Clark, the Pennsylvania-based founder of Clark Computer Services and Clark Building Technologies in Frederick and Halethorpe, said he needs new financial software to handle processing two separate taxes because of this new law. His current plan cannot file multiple tax rates for one transaction, he said.

He considered keeping the same financial software and having employees file two separate invoices manually. But he quickly learned that it’ll take up half a workday for someone to keep track of and file everything.

Clark estimates prices for this platform will spike. His current plan costs $500 a month, and his research suggests this new plan will be at least $6,000, he said. Finding the right software, training employees and migrating data all also takes time.

Clark anticipates it’ll take him six months to get everything organized and running.

All of this will cause his costs to go up, he said. That means fewer raises and bonuses for his staff of 40, who mostly live in Maryland.

“[The government is] worried about collecting every penny they can from us so they could pay for their budget deficit,” Clark told Technical.ly. “They’re solving this problem by making it harder for all their constituents.”

Confusion as to what’s taxed, how processes will work

Because he’s pivoting operations to comply, Clark wants a six-month grace period enacted so he and others can be more prepared. Mistakes may be made on his part because there’s so much to learn and adjust.

Relying on NAICS to pinpoint what’s taxed also confuses Clark. He said he’s 85% sure of what’s taxed and what’s not, because the codes are so broad.

“Six months would allow me time to get my act together so that we don’t make those mistakes, or, better yet, get into a system that automates everything so I don’t have to worry about it at all,” he said.

Kelly Schulz, the CEO of the trade association Maryland Tech Council, noted that several members she works with lack clarity on how the tax works.

“There’s still a general layer of some confusion as to how to go through the implementation,” Schulz, Maryland’s former Secretary of Commerce and Labor, told Technical.ly.

This law is in the state’s Budget Reconciliation and Financing Act, which was passed alongside the main budget package, she explained. Individual items in this legislation do not have hearings, which Schulz believes contributes to the confusion. There was some conversation about the tax during a committee hearing, but lawmakers didn’t get into specifics, she said.

The tax also came with emergency regulations, filed by the Comptroller, so companies can immediately comply. This left no time for public comment after the legislative session, she said.

Schulz believes the funds from this tax are part of the revenue that the government is counting on for the fiscal year starting today, July 1. Essentially, it’s been enacted so soon so the budget gets balanced, she said. The Governor’s Office did not confirm this reasoning.

The Comptroller of Maryland reached out to Schulz to invite tech companies to answer questions, which she appreciated.

“I think that they realize that this may be hard,” Schulz said, “and they want to be able to be supportive of the industries.”

Tech companies brace for less growth and higher costs

Clark’s businesses have been growing 34% on average for the last 10 years per year. This is the first year he’s planning without growth, and he blames the tax and the government. He’s in the process of a cost reduction exercise to make sure he stays afloat.

“I feel like our politicians have let all of us down,” he said. “Both sides really are taking advantage of us, and they’re really after their own agenda — not for us.”

Clark is concerned about other ramifications, including getting outbid by tech companies outside of Maryland. He cited the provision where out-of-state companies only have to tax the services when the gross revenue of sales exceeds $100,000 or if there are more than 200 individual sales in Maryland. Firms could do one job in Maryland per year, which would skirt the tax, he said.

Founders are also bracing for higher costs of the tech they purchase. Todd Marks, the founder of the software company Mindgrub, is building a new headquarters in Baltimore’s Pigtown neighborhood. That’s an expensive endeavor that involves purchasing a ton of tech, including cabling and software.

“This tax is just a punch in the face when you’re already down,” Marks told Technical.ly.

He noted this tax will be felt outside the tech sector. For example, he needs to purchase point-of-service systems for Mindpub, his restaurant near Mindgrub’s offices on Fort Ave.

Tax could cause business departures

Marks also sits on the IT advisory board for the Comptroller of Maryland, but hasn’t been active after the first couple of meetings, he said. Even with that connection to the agency enacting this tax, he, along with Pixee’s Patel, is considering moving Mindgrub out of the state because of the tax. He’s looking at Wyoming, Tennessee, Florida and Texas as options.

Tech companies are nimble, he said, and can easily move to a different state because customer bases and supply chains are mostly digital. He’s betting Maryland will lose businesses.

“We tax everything six ways to Sunday,” Marks said.

Clark, founder of Clark Computer Services and Clark Building Technologies, is not going to leave Maryland because all of his customers live here anyway. He would still need to charge the tax because of that.

“There’s really no maneuvering,” Clark said. “I’ve spent plenty of time trying to figure out how to get out of it. The only way I can get out of it is to commit tax fraud, which I’m not going to do.”

This isn’t “the end of the world” for businesses, per Maryland Tech Council’s Schulz, but it will be harder to be a business owner. Maryland still has qualities that make it an attractive place to headquarter a business, including proximity to the federal government.

“I certainly don’t think something like this has helped the industry want to really grow and expand here,” Schulz said. “I’m hoping that it’s maybe it’s temporary, because I think we have so many resources and assets for them without this being a barrier.”

This article mentions TEDCO, a Technical.ly client. That relationship has no impact on this report.