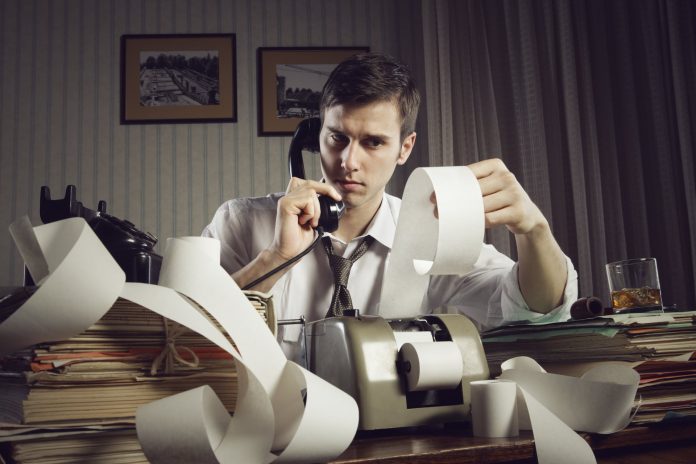

The right accountant can help you maximize savings, stay compliant, and plan for the future—but the wrong one could cost you more than you realize. While most professionals operate ethically, poor advice, mismanagement, or simple inexperience can lead to unnecessary tax bills, missed deductions, or financial headaches.

Before trusting someone with your finances, look for these red flags to ensure you work with a knowledgeable and reliable professional.

1. They Ask You to Sign Blank Tax Returns

Never sign a blank tax return—this hands control to a preparer who could manipulate your filing, inflate deductions, or divert your refund to their own account. A trustworthy accountant will always provide a fully completed return for review before submission.

Tax fraud can lead to audits, penalties, or even legal trouble, but a few simple steps can protect your finances. Double-check all details, verify your refund destination, and ensure your preparer signs the return with their Preparer Tax Identification Number (PTIN). Taking these precautions keeps your money where it belongs and safeguards you from costly mistakes.

Understanding where your money goes is just as important as who manages it. If you’re working to protect your finances, it’s also crucial to make smart investment choices that minimize taxes and maximize long-term growth.