- Circle went public last week.

- The stock doubled in price the day of launch.

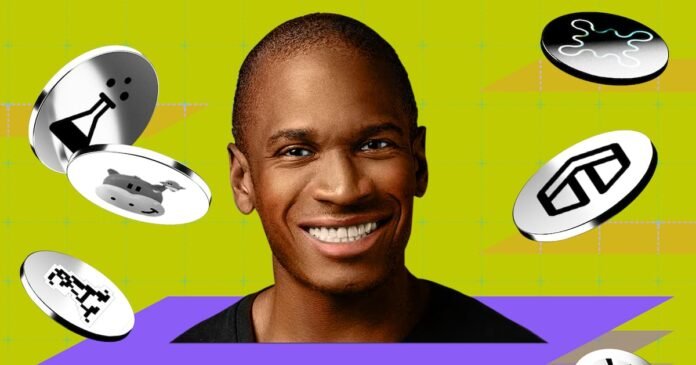

- Arthur Hayes said that stablecoin incumbents have already won.

Don’t bother.

That’s the message Maelstrom CIO Arthur Hayes offers startups looking for a slice of the $251 billion stablecoin market.

Why? ‘Cause they lack distribution channels.

“If a stablecoin issuer or tech provider cannot distribute through a crypto exchange, Web2 social media giant, or legacy bank, they have no business,” Hayes said in a Wednesday blog.

“There is no real future because the distribution channels for new entrants are closed.”

His warning comes as the buzz around stablecoins has reached fever-pitch. Not only did Circle’s blockbuster IPO lit up markets with a triple-digit jackpot for investors, but a growing number of banks like Bank of America, and even tech giants like Uber are said to be exploring stablecoins.

At the same time, the US government is gearing up to pass landmark stablecoin bills like the Genius Act, seemingly paving the way for more firms to flood the market.

However, that won’t change the brutal reality that distribution is king, said Hayes.

Two big players

The stablecoin market is highly concentrated.

Tether’s USDT dominates with over 62%, followed by Circle’s USDC with 24%, according to DefiLlama. A spattering of smaller stablecoins like Ethena’s USDe and DAI follow suit.

Stablecoins only succeed if they can get into the hands of millions of users quickly and cheaply, Hayes said. The problem for would-be stablecoin challengers is that those distribution channels are mostly spoken for.

While traditional banks are adopting stablecoins, it’s unlikely they’ll partner up with third parties for the technological development or distribution, Hayes said.

“Regulators may explicitly forbid it,” he said, arguing that this distribution channel is closed to stablecoin startups.

In-house building

What about social media companies like X who are reportedly in early conversations to integrate stablecoins?

Well, they’ll likely “build everything needed to power their stablecoin business in house,” Hayes said.

To be sure, Hayes is bullish for the stocks of companies staring down the herculean task of disrupting the stablecoin market. At least in the interim.

“Do not go short,” said Hayes. “These new stocks will rip the faces off of shorts.”

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.